Jan 20–23, 2026: Global Earnings Week Ahead

Jan 20–23, 2026 Earnings Preview: S&P 500, STOXX 600, Luxury Leaders, Energy Giants, ECB Signals, and Dollar Strength

Research suggests that the global economy remains resilient in early 2026, with steady growth offsetting potential trade headwinds. It appears likely that S&P 500 earnings will reflect moderate gains, while results from the STOXX 600 may underscore mounting challenges in the luxury sector. The evidence leans toward a stable outlook, though US dollar strength and ECB policy add layers of complexity.

- Following the Monday holiday lull, markets shift back to earnings on Tuesday as Johnson & Johnson leads off, with Netflix rounding out the week’s highlights.

- Luxury brands such as LVMH face scrutiny amid shifting consumer trends, with Hermes following later in the year.

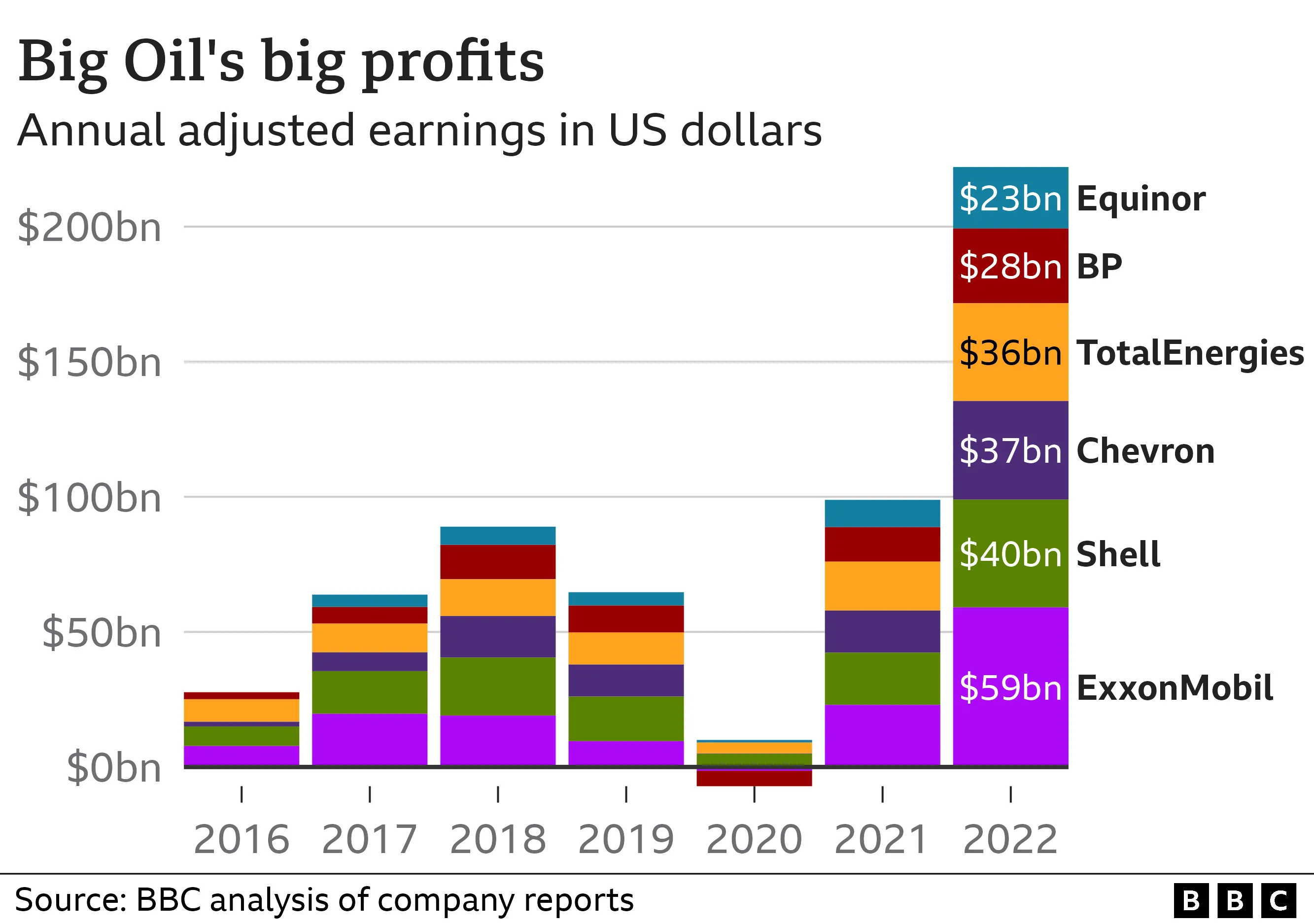

- Energy giants like Halliburton and Schlumberger report, influenced by oil prices and global demand.

- US markets are closed today (Jan 19) for MLK Day, but futures are trading cautiously as President Trump has issued fresh tariff threats against several European nations regarding trade disputes.

- The unexpected strength in January could impact multinational earnings.

Key Earnings Highlights

This week brings earnings from more than 180 S&P 500 companies, centring attention on healthcare, tech, and consumer sectors, as the STOXX 600 schedule remains light aside from LVMH, which offers a key read on European luxury demand.

Economic Context

The International Monetary Fund and the World Bank project global growth of around 3.3% in 2026, supported by continued investment in technology. Fed rates are expected to hold through the year, with no January cut. US dollar trends show surprising vigour, defying earlier forecasts.

What to Watch

Traders should monitor post-earnings reactions, especially in volatile sectors like tech and energy.

As we dive into the earnings season for January 20-23, 2026, investors are gearing up for a pivotal week that could shape market sentiment for the quarter. With the S&P 500 and STOXX 600 in focus, this preview highlights earnings from luxury heavyweights LVMH and Hermès, alongside major energy firms and the broader impact of European Central Bank policy signals. interest rates and US dollar strength. Backed by fresh data from the IMF, World Bank, and Federal Reserve trends, we'll break down what to expect, including detailed explanations, stats, and practical tips for navigating these announcements. Let's get into it – conversationally, as if we're chatting over coffee about where the markets might head next.

A Hook to Start: Why This Week Matters

It’s early 2026, and the global economy is ticking along at a 3.3% growth rate, based on the most recent International Monetary Fund World Economic Outlook. Yet beneath the surface, trade tensions, AI-driven booms, and shifting currencies are creating powerful crosscurrents. This week’s earnings aren’t just figures on a balance sheet—they’re a real-time pulse check on how companies are adapting.

Results from Netflix and LVMH hit at a defining point, where S&P 500 innovation meets slowing European consumer demand—setting up the possibility of 1–2% fluctuations across global indices. Add in a surprisingly strong US dollar, and multinationals could soon reveal whether currency moves are turning into headaches or unexpected windfalls. Intriguing, right? Stick around as we break it all down.

With global growth now projected at 2.6% for 2026, the World Bank highlights resilience in the face of trade barriers and changing investment flows. However, threats ranging from AI bubbles to geopolitical shocks remain, making a targeted investment approach—favouring energy and luxury sectors with solid fundamentals—especially prudent.

Inside the S&P 500: Healthcare and Tech Drive Earnings Momentum

The S&P 500 kicks off earnings season on a strong note, with analysts forecasting roughly 15% year-over-year Q4 2025 earnings growth, according to insights from FactSet. This week alone, expect reports from 180+ companies, grouped by date for easy tracking.

Here's a handy table of key S&P 500 earners this week:

| Date | Company (Ticker) | Sector | EPS Estimate | Revenue Estimate | Reporting Time | Key Watch Points |

|---|---|---|---|---|---|---|

| Jan 20 | Johnson & Johnson (JNJ) | Healthcare | $2.47 | N/A | BMO | Vaccine sales and supply chain updates |

| Jan 20 | Netflix (NFLX) | Tech/Entertainment | $0.55 | N/A | AMC | Subscriber growth amid streaming wars |

| Jan 22 | GE Aerospace (GE) | Industrials | $1.43 | N/A | BMO | Aviation recovery and energy transition |

| Jan 22 | Procter & Gamble (PG) | Consumer Goods | $1.86 | N/A | BMO | Inflation impacts on pricing |

| Jan 20 | Intuitive Surgical (ISRG) | Healthcare | $2.27 | N/A | AMC | Robotic surgery demand |

| Jan 20 | Charles Schwab (SCHW) | Financials | $1.39 | N/A | BMO | Trading volumes and interest income |

| Jan 21 | Halliburton (HAL) | Energy | N/A | N/A | BMO | Oilfield services amid price volatility |

| Jan 22 | Intel (INTC) | Tech | $0.08 | N/A | AMC | Chip shortages and AI investments |

| Jan 23 | Schlumberger (SLB) | Energy | N/A | N/A | BMO | Global drilling trends |

These reports come amid a resilient US economy, with Fed projections holding rates steady through 2026 at 3.5-3.75%. Practical tip: If JNJ beats estimates, it could lift healthcare ETFs like XLV – consider options plays for short-term gains. On the flip side, if Netflix misses on subscribers, watch for a pullback in FAANG stocks.

STOXX 600 Preview: Luxury in the Limelight

European markets, as tracked by the STOXX 600, are expected to see more subdued growth, with the World Bank projecting earnings-linked regional expansion of around 2.4% in 2026. This week focuses on luxury, where LVMH's annual results (expected around Jan 21) could signal consumer spending health.

As a bellwether for the luxury industry, LVMH reports at a time when eurozone inflation is hovering around 1.9% in 2026. Analysts are watching for earnings per share of about €10.10, with potential revenue headwinds stemming from U.S. tariffs. Hermes, while not reporting this week (Q1 revenue in April), influences sentiment – its shares have held steady despite dollar strength.

Tip: For diversified exposure, consider STOXX 600 ETFs like VGK. If LVMH highlights China slowdowns, short luxury peers via options.

Energy Giants: Riding Oil Waves

Energy reports spotlight giants like Halliburton (Jan 21) and Schlumberger (Jan 23), with sector earnings buoyed by stable oil prices around $80/barrel. IMF notes energy as a growth driver in emerging markets.

Practical advice: Watch for capex guidance – if giants signal increased drilling, it's bullish for XLE ETF. Bullet points on trends:

- Global demand up 1.2% in 2026, per the World Bank.

- Geopolitical risks could spike volatility.

- Transition to renewables: Expect updates on green investments.

ECB Interest Rates: Steady as She Goes

No ECB decision this week (next on Feb 5), but recent holds at 2% reflect cooling inflation to 1.9% in 2026. This stability supports European stocks, per STOXX outlooks.

Tip: If earnings mention rate impacts, pair with euro trades – EUR/USD at 1.17 amid dollar trends.

US Dollar Strength: A Double-Edged Sword

The dollar's robust start to 2026 (DXY near 98) defies forecasts, up 0.24% early January. This could crimp exporter earnings but boost importers.

Federal Reserve trends point to no rate cuts in January, with policy likely on hold through 2026. Tip: consider hedging with USD pairs or gold, which has pushed to new highs.

Mini Case Study: Johnson & Johnson's Resilience Amid Economic Shifts

Johnson & Johnson (JNJ) reports Jan 20 after a standout 2025, when revenue hit a record $95 billion, up 6%, fueled by pharmaceuticals and double-digit Stelara growth. Looking into 2026’s 3.3% global expansion, EPS beats remain possible if logistics pressures stay contained. That said, currency headwinds persist, with dollar strength shaving roughly 2% off international sales last quarter. The lesson for investors: JNJ’s diversification and near-3% dividend yield offer ballast in uncertain markets.

For more, check our internal guides: Nike Official Website - Shop the Latest Collection and How to Invest in Luxury Stocks. External: IMF World Economic Outlook.

Wrapping It Up: Stay Informed and Act

This week’s earnings signal a steady but cautious backdrop—growth is holding up, though currencies and interest rates remain key watch points. With the International Monetary Fund projecting 3.3% global growth, technology and energy emerge as key sectors offering potential upside.

Call to action: Subscribe to our newsletter for real-time updates, or dive into our investment tools toanalysee these stocks yourself. What's your top pick this week? Comment below!

FAQs: Trending Questions Answered

What earnings are analysts forecasting for LVMH in 2026? Analysts project €10.10 EPS for LVMH's annual results, with revenue growth tempered by 1.9% eurozone inflation. Trending query: How do tariffs affect luxury? They could add 5-10% costs, per recent models.

Will the ECB cut rates soon? No cut expected until Feb 5; hold at 2% amid stable growth. Trending: Impact on mortgages? If rates ease, payment obligations could fall by around 0.5% in 2026.

What is the strength of the US dollar in January 2026? DXY near 98, up 0.24% – stronger than forecasted. Trending: Why the rally? Fed holds, and AI investments boost sentiment.

Which energy giants report this week? Halliburton and Schlumberger expect oil demand insights. Trending: Renewable shift? Giants allocating 20% capex to green tech.

S&P 500 growth outlook? 15% earnings rise, per FactSet. Trending: Recession risk? Low, with 2.2% US GDP forecast.

Comments

Post a Comment