Robinhood Q4 2025 Earnings & Analyst Upgrades

Analyst Upgrades Robinhood Rating Ahead of Earnings: What It Means for Your Portfolio

Key Takeaways

- Analyst Optimism: Multiple firms upgraded or reaffirmed positive ratings on Robinhood ahead of earnings, citing diversification and scalable profitability.

- Q4 2025 Results: Revenue reached $1.28 billion (up 27% YoY) with EPS of $0.66, beating estimates, though a top-line miss and crypto weakness led to post-earnings volatility.

- Business Maturity: Strong growth in options, interest income, subscriptions (Robinhood Gold), and user engagement shows the platform has evolved beyond commission-free trading.

- Long-Term Tailwinds: Crypto integration, international expansion, and a structural shift in retail trading support analysts' constructive outlook despite near-term challenges.

- Portfolio Perspective: Upgrades signal confidence, but evaluate valuation, volatility, and diversification— this is not financial advice.

Introduction: Why Robinhood's Momentum Matters in 2026

As of February 2026, Robinhood Markets (HOOD) continues to capture attention in the fintech sector. Ahead of its Q4 2025 earnings release on February 10, several Wall Street analysts upgraded ratings or raised price targets, reflecting growing belief in the company's transition to a mature, profitable platform. The report delivered a mixed but ultimately resilient picture: record full-year revenue of $4.5 billion, EPS of $2.05, and a Q4 EPS beat, even as quarterly revenue slightly missed expectations amid softer crypto activity.

This moment represents more than one earnings cycle. Robinhood, which launched commission-free trading in 2013 to "democratize finance," has matured into a diversified financial super-app. Once criticized for enabling speculative trading, it now generates steady revenue from options, cryptocurrency spreads, interest on cash balances, and premium subscriptions. The analyst upgrades underscore Wall Street's recognition that retail investing is a permanent structural shift, not a fad.

For investors, the developments matter because they highlight how technology continues to reshape access to markets. Younger and first-time investors have embraced mobile-first platforms, creating loyal users who engage across multiple products. Yet challenges remain: market volatility, regulatory scrutiny, and competition from established brokers like Charles Schwab and Fidelity.

The upgrades—such as Wolfe Research moving to Outperform with a $125 target—came as analysts modeled stronger operating leverage and user monetization. Post-earnings, some price targets were adjusted (e.g., Barclays lowered to $124 while maintaining Overweight), but the consensus remains Moderate Buy with average targets around $120–$130, implying meaningful upside from recent levels.

Whether you're a Robinhood user, shareholder, or observer of fintech trends, the company's progress offers insights into the future of retail finance. Let's examine what drove the analyst's confidence and what the earnings reveal. Despite a strong EPS beat, the market reacted sharply to the revenue miss in the crypto segment, causing an 11% dip in share price on February 11, 2026.

Understanding the Analyst Upgrades

Analyst upgrades reflect detailed research into fundamentals, competitive positioning, and growth prospects. In Robinhood's case, firms highlighted several positives:

- Proven Profitability: After years of investment in growth, Robinhood has consistently delivered profits. Q4 2025 EPS of $0.66 beat estimates, contributing to full-year EPS of $2.05. This validates the business model at scale.

- Revenue Diversification: No longer reliant on trading volume alone, the company benefits from high-margin streams such as options trading, crypto services, and interest income (which grew 39% in Q4).

- User Metrics: Continued growth in monthly active users, assets under custody (reaching hundreds of billions), and Robinhood Gold subscribers demonstrates engagement and monetization potential.

- Crypto and Innovation: Despite a Q4 crypto revenue dip tied to market conditions, Robinhood's integrated platform positions it for recovery as digital assets mature.

Price targets were raised in some cases by 15–25% pre-earnings, based on projections of sustained 25–40% revenue growth and expanding margins. These are not guarantees—markets remain volatile—but they indicate analysts view the stock as undervalued relative to its growth trajectory.

Robinhood's Evolution: From Disruptor to Profitable Platform

Robinhood's early years were marked by rapid user acquisition but questions about sustainability. The shift to profitability came through deliberate diversification:

- Options and Derivatives: Now a major revenue driver with attractive margins.

- Cryptocurrency: Users drawn to Bitcoin and Ethereum often expand into equities, creating cross-selling opportunities.

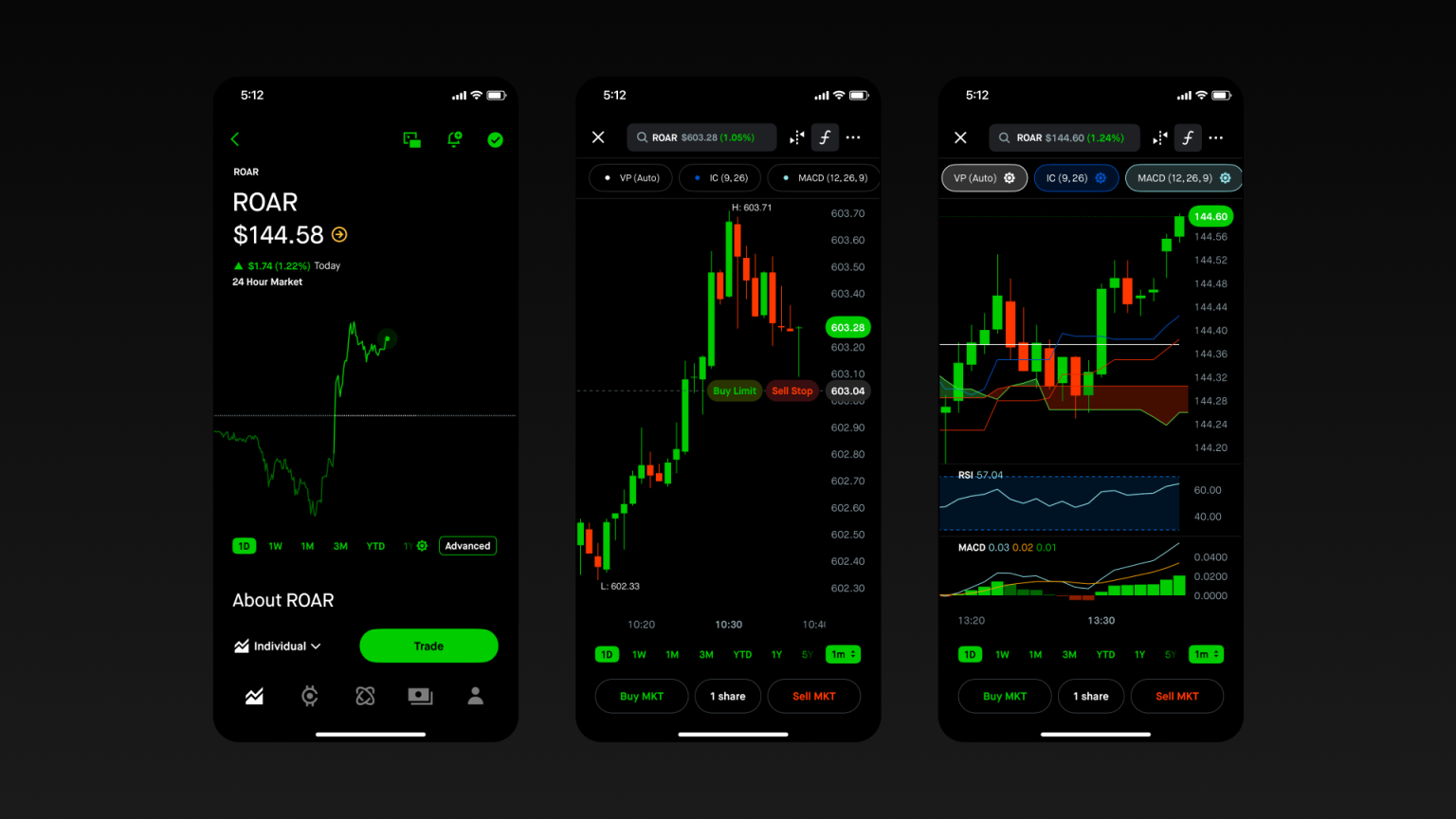

- With its recent acquisition of MIAXdx, Robinhood is positioning itself to enter the event-betting market, which analysts view as a major growth catalyst for 2026.

- Cash Management and Gold: Interest on uninvested cash and the $6/month Gold subscription (offering margin, advanced data, and more) provide recurring revenue.

- Stock Lending and Other Services: Additional streams that scale with platform size.

The 2021 meme-stock episode tested the company, leading to improved compliance, technology, and risk management. By 2025–2026, Robinhood will have built resilience while maintaining its core appeal: an intuitive mobile experience that lowers barriers for new investors.

Q4 2025 Earnings: Key Highlights and Implications

Robinhood reported record full-year 2025 revenue of $4.5 billion (52% growth) and delivered a Q4 EPS beat despite a modest revenue miss ($1.28 billion vs. ~$1.3 billion expected). Key metrics included:

- Strong interest income and options growth offsetting softer crypto.

- Healthy user and asset growth, with assets under custody expanding significantly year-over-year.

- Operating leverage: Costs per user declining as the platform scales.

The slight top-line shortfall, partly due to crypto market dynamics (Bitcoin volatility in late 2025), contributed to post-earnings selling pressure. However, management emphasized diversification and excitement for 2026 initiatives, including potential expansion into prediction markets and private markets.

Analysts largely viewed the results positively in the context of a maturing business. The EPS beat and full-year records reinforced confidence that Robinhood can grow profitably even in varied market conditions.

The Broader Fintech and Retail Trading Landscape

Retail trading has stabilized at elevated levels since the 2020–2021 surge. Mobile apps, zero commissions, and social communities have made investing accessible to millions who previously stayed on the sidelines. Robinhood benefits from this trend while facing competition.

Competitive Advantages:

- Intuitive UX and brand affinity among younger users.

- Seamless crypto integration (a differentiator as digital assets gain mainstream traction).

- Network effects from community features.

Industry Tailwinds:

- Growing crypto adoption.

- Rising options participation.

- International expansion opportunities where commission-free models are still emerging.

- Regulatory maturation provides greater clarity.

Challenges include market downturns, reducing volumes, potential new regulations, and resource-rich incumbents enhancing their digital offerings.

Investment Considerations: Is Robinhood Right for Your Portfolio?

Supportive Factors:

- Demonstrated profitability and growth combination.

- Large addressable market of under-banked or new investors globally.

- Structural shifts favoring digital, low-cost platforms.

- Crypto and innovation upside.

Risks to Weigh:

- Revenue sensitivity to market volatility and crypto prices.

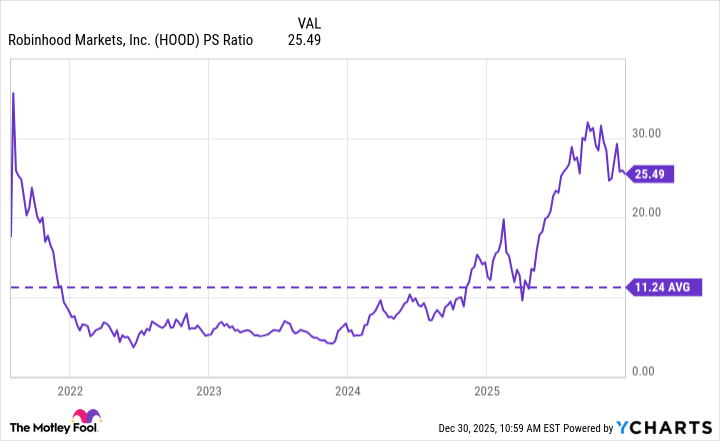

- Valuation: After strong 2024–2025 runs, the stock trades at a premium that assumes continued execution.

- Competition and execution risks in new areas like international growth.

- Broader economic factors affecting retail investor sentiment.

For portfolio construction, consider position sizing (e.g., limit to 3–5% for growth-oriented investors) and time horizon. Long-term believers in retail fintech may see value in the current setup, while others might prefer waiting for dips or pairing with more defensive financial stocks.

Always align decisions with your risk tolerance, goals, and overall diversification. Analyst views provide one data point—conduct your own research using company filings, earnings transcripts, and multiple sources.

Looking Ahead: Robinhood's 2026 Trajectory

Management expressed optimism for 2026, focusing on product innovation, profitable growth, and new offerings. Key questions include sustaining margins amid potential market normalization, scaling internationally, and capitalizing on crypto recovery.

If Robinhood executes well, analysts see potential for continued outperformance in a sector undergoing digital transformation. However, execution, macroeconomic conditions, and competitive responses will determine the pace.

FAQs

Q: Should I buy HOOD stock following the upgrades and earnings? A: It depends on your personal situation. Upgrades reflect professional analysis, but weigh them against your research, risk tolerance, and portfolio needs. Consult a financial advisor.

Q: How did crypto impact the results? A: Crypto revenue faced headwinds in Q4 due to market conditions, but the company's diversified model limited the overall effect.

Q: What are the current analyst price targets? A: Consensus hovers around $120–$130 with a Moderate Buy rating, though individual targets vary post-earnings.

Q: Is Robinhood safe for beginners? A: Its interface is user-friendly, but complex products like options require education. Start small and use available learning resources.

Q: How does Robinhood protect customer assets? A: As a regulated broker-dealer, it participates in SIPC protection up to $500,000 per customer.

Final Thoughts

The analyst upgrades and Q4 2025 earnings underscore Robinhood's evolution into a profitable, diversified fintech leader. While not without risks or volatility, the company benefits from powerful secular trends in retail investing and digital finance.

Treat this as informational only—not a recommendation to buy or sell. Stay informed through official channels, maintain a long-term perspective, and make decisions aligned with your financial plan. The retail trading revolution Robinhood helped spark continues, and well-positioned investors may find opportunities as the platform matures.

Disclaimer: All content published on Marqzy is for educational and informational purposes only and should not be construed as financial advice. We are not SEBI-registered financial advisors. Investments in the stock market, mutual funds, or other financial instruments carry inherent risks. Please seek advice from a qualified financial professional and perform independent due diligence before investing. Marqzy shall not be held liable for any financial losses incurred as a result of reliance on this content.

Comments

Post a Comment