Gold vs Crypto 2026: Which is a Better Hedge?

Gold vs. Crypto in 2026: Which is the Better Hedge Against Economic Uncertainty?

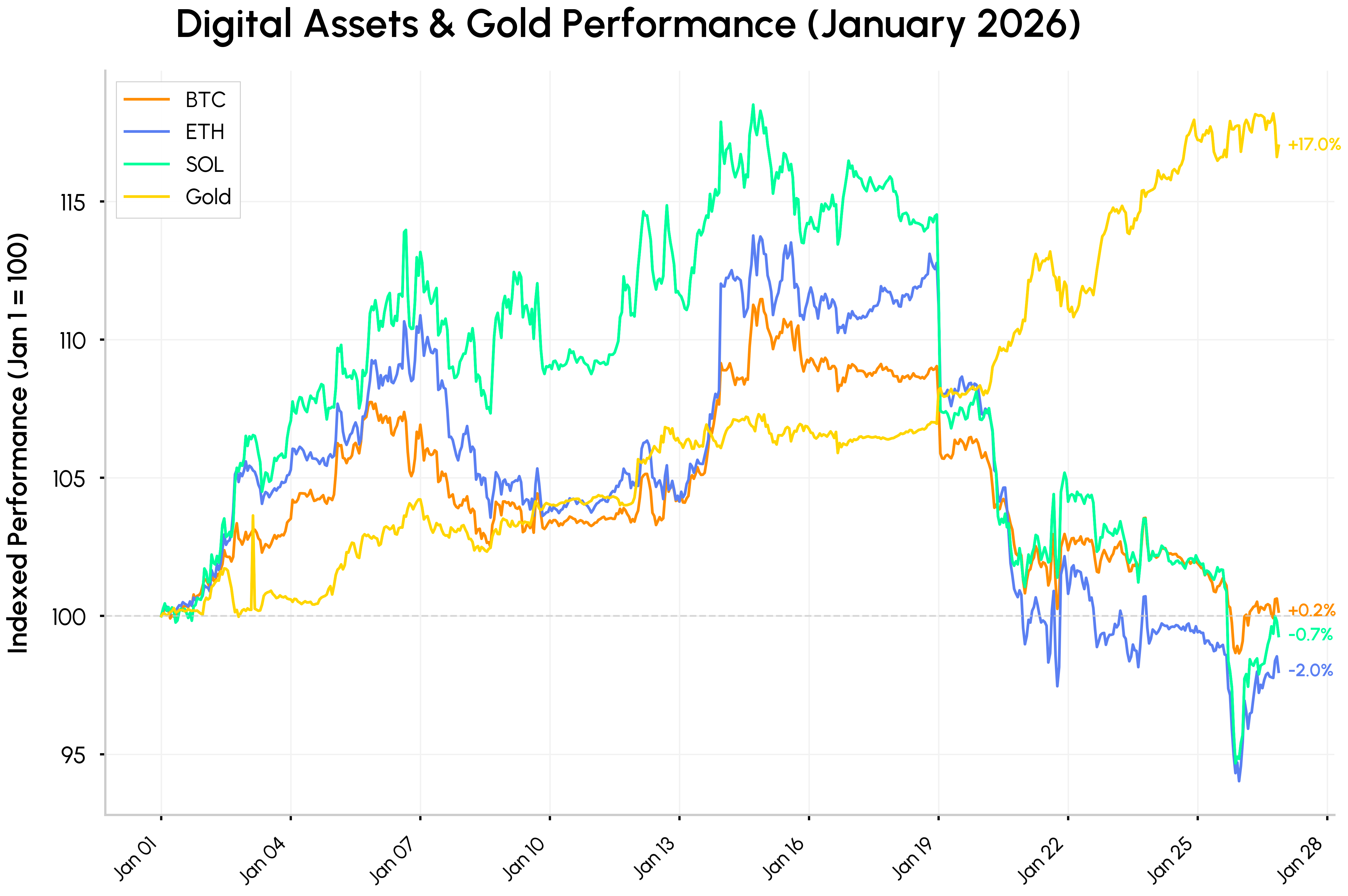

In early 2026, with ongoing economic worries like policy changes, geopolitical risks, and market swings, gold stands out as the more reliable hedge for most investors. Gold prices have hit record highs around $5,000–$5,600 per ounce, driven by safe-haven demand, while Bitcoin hovers near $76,000 after sharp drops from late-2025 peaks.

Key Points

- Gold leads as a stable hedge: Research and market data show gold performing better in uncertain times, with strong central bank buying and lower volatility.

- Bitcoin offers high reward but high risk: It acts as "digital gold" for some, but recent performance shows it struggling against macro pressures, making it less dependable for protection.

- Inflation and uncertainty favour gold: The evidence leans toward gold as the better inflation hedge due to its history and current trends, though Bitcoin appeals to growth-focused investors.

- Diversify wisely: Many experts suggest holding both, based on your risk level.

Current Prices and Outlook

Gold trades near $5,062 per ounce as of February 2026, up sharply year-on-year. Forecasts point to continued strength, with J.P. Morgan expecting averages around $5,055 by late 2026. Bitcoin, meanwhile, is around $76,000, down from higher levels.In the Indian market, this global surge has pushed MCX gold prices to a historic high of ₹1,60,000 per 10 grams in early 2026, reflecting the strong domestic demand alongside global trends.

Why Gold Feels Safer Right Now

Gold benefits from central bank purchases, lower interest rate expectations, and its role as a store of value. Bitcoin, while innovative, faces more swings tied to tech sentiment and regulation.Practical Tips

Start small with gold ETFs or digital platforms for ease. For crypto, use secure wallets and only invest what you can afford to lose.Gold vs. Crypto in 2026: A Deep Dive into Hedging Economic Uncertainty

As we move through 2026, investors face a world of questions. Global growth is steady at 3.3%, according to the IMF, but risks from trade tensions, policy shifts, and geopolitical issues keep uncertainty high. US business leaders rank uncertainty as their top worry for the year. In this setting, people often turn to assets that hold value when stocks or currencies falter. The big debate is between gold, the classic safe-haven, and crypto, especially Bitcoin, often called "digital gold". Which one protects better against economic uncertainty, inflation, and market drops in 2026?

The Economic Backdrop in 2026

The IMF's January 2026 update projects global growth holding at 3.3% for the year, supported by technology advances, easier money policies, and flexible businesses. Inflation is easing in many places, but the US may see it return to target more slowly. Downside risks include shifts in tech expectations and rising geopolitical tensions. The Federal Reserve's December 2025 projections and market views suggest rates may stay steady or ease slightly, with the funds rate around 3.5–3.75%. This environment—growth with risks—favours assets that do well when confidence dips.

Uncertainty indices have spiked in past crises, and 2026 shows similar patterns with policy and global worries. Investors seek protection.

Gold's Role as a Traditional Safe-Haven

Gold has long been a go-to hedge. It has no yield but holds value through history. In 2026, gold prices have surged to over $5,000 per ounce, reaching an all-time high of $5,608 in January. As of early February, it sits at around $5,062, up 76% year-on-year.

Key drivers include:

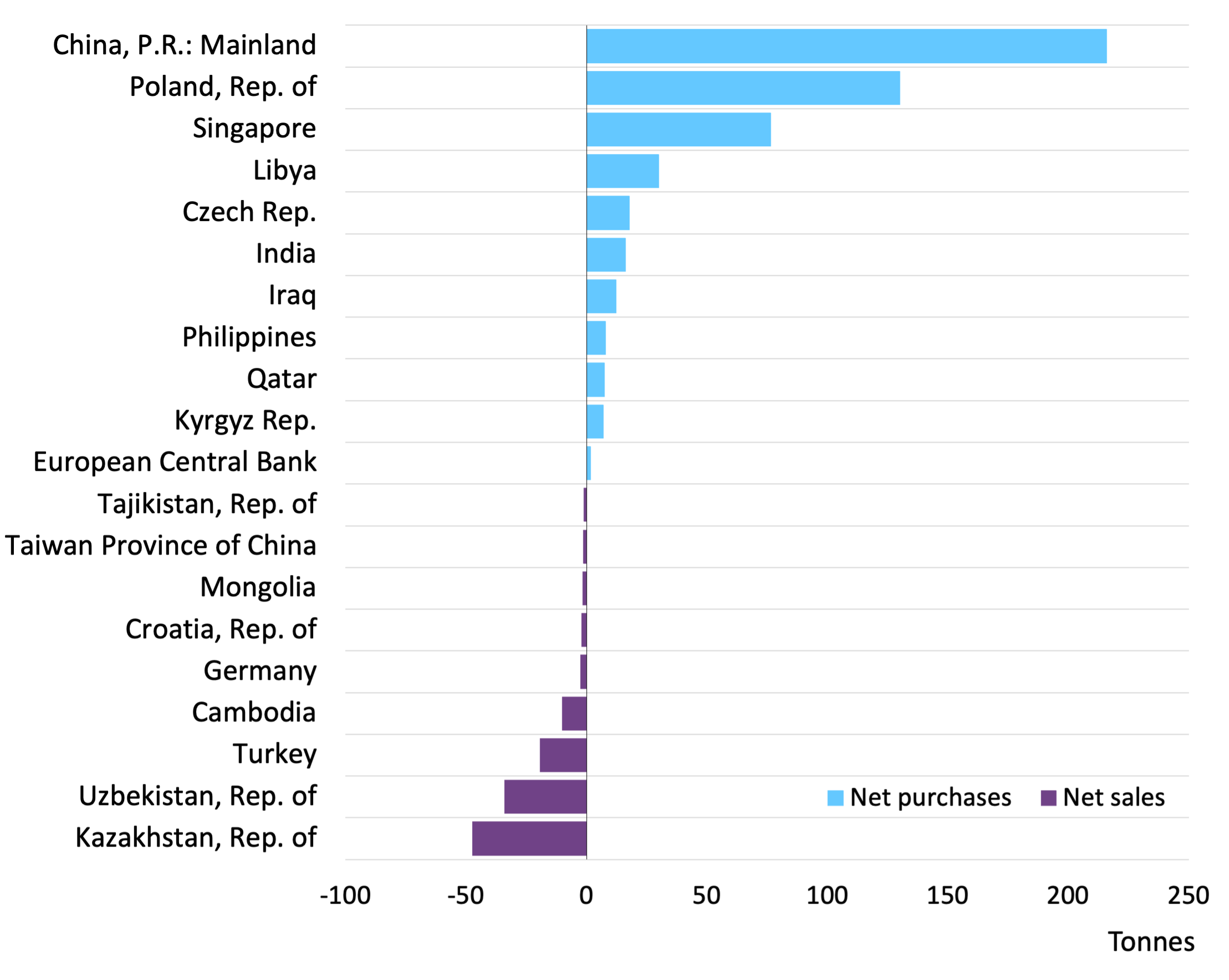

- Central bank demand: Banks buy gold to diversify reserves away from the US dollar. J.P. Morgan expects 755 tonnes annually in 2026, above pre-2022 levels.

- Investor interest: Bars, coins, and ETFs see strong inflows amid lower rates and uncertainty.

- Geopolitical and macro factors: Tensions and possible Fed cuts boost appeal.

Forecasts vary but lean bullish. J.P. Morgan sees $5,055 average in Q4 2026, with potential for $6,000 longer-term. The World Gold Council notes range-bound performance under baseline, but gains in slowdown scenarios.

Bitcoin and Crypto as a Modern Alternative

Bitcoin is often pitched as digital gold—scarce, decentralized, and a hedge against money printing. Yet in 2026, it trades around $76,000, down from 2025 highs. Predictions range widely, from $75,000 to over $200,000, but recent data shows underperformance vs gold.

Strengths include growth potential and institutional adoption. Weaknesses are high volatility and ties to risk sentiment.

| Head-to-Head Comparison: Gold vs Bitcoin in 2026 | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Note: Halanki Gold ko sabse safe mana jata hai, par dhyan rahe ki Jan 2026 ke end mein isne ek short-term correction (dip) dikhaya tha. Iska matlab hai ki safe assets mein bhi patience zaroori hai. Wahi dusri taraf, Bitcoin un logon ke liye hai jo high risk lekar high returns chahte hain. | ||||||||||||||||||||||||||

Best Hedge Against Inflation in 2026

Inflation worries persist. Gold has a strong history here, rising with money supply growth. Bitcoin aims to counter debasement but shows more correlation with risk assets lately. Evidence points to gold as steadier.

A Note on Market Corrections: While gold is a safe haven, it is not immune to short-term dips. The 10% price correction seen in late January 2026 serves as a reminder that even 'safe' assets require a long-term perspective (3-5 years) rather than quick speculative trades."

Digital Gold Investment Tips

- Use gold ETFs or apps for easy access without physical storage.

- Consider sovereign coins or bars from trusted dealers.

- Allocate 5–10% of the portfolio for balance.

- Watch central bank trends and Fed moves.

- For crypto, use regulated exchanges and hardware wallets.

Mini Case Study: Central Banks and Gold Buying

Central banks have ramped up gold purchases since 2022, hitting record levels to diversify reserves. In recent months, nations like China, Poland, and India (RBI) led net buys, supporting prices even at high levels. This structural demand from major economies provides a floor under gold.

Conclusion

In 2026, gold looks like the safer bet for hedging uncertainty and inflation, thanks to its stability and demand drivers. Bitcoin suits those seeking growth, but with more risk. Diversify based on your goals. Speak to a financial advisor and research further before investing.

FAQs

What is the gold price forecast for 2026? Most analysts see averages around $5,000+, with bullish views up to $6,000.

Is Bitcoin better than gold as a hedge in 2026? Not currently—gold outperforms amid macro risks, though Bitcoin has upside potential.

What is the best hedge against inflation in 2026? Gold, due to its track record and low correlation to other assets.

How can I invest in digital gold? Through ETFs, apps, or platforms offering gold-backed tokens.

Should I hold both gold and crypto? Yes, for diversification, if your risk tolerance allows.

Disclaimer: All content published on Marqzy is for educational and informational purposes only and should not be construed as financial advice. We are not SEBI-registered financial advisors. Investments in the stock market, mutual funds, or other financial instruments carry inherent risks. Please seek advice from a qualified financial professional and perform independent due diligence before investing. Marqzy shall not be held liable for any financial loss incurred.

Key Citations

- Trading Economics: Gold Price Data

- J.P. Morgan: Gold Price Forecasts

- World Gold Council: Gold Outlook 2026

- IMF World Economic Outlook Update January 2026

- Yahoo Finance: Bitcoin Price History

- Various sources on CEO concerns and market outlooks (e.g., Fox Business, Brookings)

Comments

Post a Comment