The 2008 Replay? Unchecked Private Credit and Shadow Banking Risks to US and European Financial Systems

- Private credit's boom echoes 2008's shadow banking pitfalls: With assets hitting $3 trillion globally in 2025, lax rules could spark defaults and contagion, much like subprime woes.

- US leads the charge, Europe follows closely: America's $1.5 trillion market dominates, but Europe's growing ties raise spillover fears for pensions and banks.

- Hidden dangers in opacity and leverage: Without transparency, high-risk loans to shaky firms threaten stability—experts warn of a $2 trillion subprime-style risk.

- Lessons from history demand action now: Regulators must step up to avoid a replay; investors, diversify wisely to shield your portfolio.

- Real-world red flags like Deere's woes: Rising credit losses in equipment financing show how everyday sectors feel the pinch.

Imagine it's 2007. The air buzzes with easy money talk. Banks hand out loans like sweets at a fair, bundling dodgy mortgages into shiny packages sold to anyone with a wallet. No one bats an eye at the risks—until Lehman Brothers topples like a house of cards, and the world freezes in panic. Jobs vanish, homes foreclose, and governments pump trillions to stop the bleed. That was the 2008 financial crisis, a scar that still itches on the global economy.

Fast forward to October 2025. Sound familiar? Swap "subprime mortgages" for "private credit," and "securitised debt" for "shadow banking funds." The stage is set for what could be a 2008-style rerun. Private credit—loans from non-bank lenders like hedge funds and private equity giants—has exploded to $3 trillion worldwide. In the US, it's a whopping $1.5 trillion beast, with Europe nipping at its heels through funds like London's Intermediate Capital Group, which just raised $50 billion. Shadow banking, the murky underbelly where these deals brew without bank-like oversight, now holds $63 trillion in assets—78% of global GDP. That's bigger than the entire banking system in many countries.

Why the déjà vu? Post-2008 rules clamped down on banks, forcing them to hoard cash and check borrowers twice. Smart move, right? But it created a vacuum. Enter private credit: faster, looser, hungrier for deals. Firms like Blackstone and Ares swoop in, lending to risky outfits—think over-leveraged buyouts or startups on the edge—for juicy returns banks won't touch. Yields? Up to 10-12% in a low-rate world, luring pension funds and insurers. But here's the hook: no public filings, no stress tests, just a black box of debt.

Picture this: A mid-sized US car parts maker borrows big from a private credit fund to expand. Rates climb, sales dip, and poof—default. The fund, backed by bank credit lines, calls in favours. Banks feel the sting, stocks wobble, and panic spreads like wildfire across the Atlantic to European lenders exposed via cross-border deals. Sound like fiction? Just look at recent cracks: US lender Tricolor's collapse in 2025, laced with fraud claims, cost JP Morgan $170 million. Or First Brands, a supplier that tanked, hitting Jefferies for $715 million. Jamie Dimon, JP Morgan's boss, called it "one cockroach"—implying more lurk.

This isn't scaremongering; it's a wake-up. The IMF's Kristalina Georgieva says non-bank lending keeps her up at night, fearing contagion to real banks. The Bank of England echoes: Highly indebted firms could default en masse, spilling shocks to the UK. And with US deregulation under Trump 2.0 scrapping safeguards, the fuse shortens.

But let's zoom out. Private credit isn't all villain. It fuels growth: Small businesses get cash when banks say no, infrastructure projects hum in Europe. Yet unchecked, it risks The 2008 Replay. Opacity hides bad loans—defaults hit 5% in 2025, up from 2% pre-pandemic. Leverage? Funds borrow 1:1 against assets, amplifying losses. Interlinks? Banks lend $1 billion yearly to these players, per Fed data. A recession—whispered amid 2025's slowing growth—could trigger runs on funds, echoing money market freezes in '08.

Take John Deere as a gritty example. The tractor giant, a farming icon, relies on financing equipment sales through securitised loans—shadow banking's playground. In Q1 2025, Deere's provisions for credit losses doubled to $200 million amid ag slumps. Why? Farmers, squeezed by high rates and low crop prices, miss payments on $774 million in bundled contracts Deere sold off. Investors in those notes—often private credit vehicles—face haircuts. Deere's stock? Down 15% year-to-date, from $450 to $382, dragging farm indices. It's a microcosm: Everyday sectors like ag, tied to private lending, amplify systemic shakes.

Across the pond, Europe's no bystander. The EU's private credit market, though smaller at $500 billion, grows 20% yearly, per BlackRock forecasts. Pensions commit £50 billion over five years, per UK Chancellor Reeves. But ties to US funds mean a Yankee sneeze could cause Euro flu. Remember Archegos in 2021? Family offices blew up prime brokers; scale that to private credit.

The math chills: Shadow banking's $63 trillion dwarfs 2008's $28 trillion. Defaults correlate in downturns—think 10% spike if GDP dips 2%. Banks' indirect exposure? 80% of business development companies (BDCs) borrow from them, per Boston Fed. A $2 trillion "subprime" bubble, warns Seeking Alpha, lurks in illiquid loans to junk-rated firms.

Yet hope flickers. Regulators eye fixes: IMF pushes stress tests for non-banks. Investors? Demand transparency. Policymakers? Bridge the arbitrage gap where private lenders dodge capital rules.

What is Private Credit, and Why Does It Matter in the Shadow Banking World?

Private credit sounds posh, doesn't it? Like a secret club for the wealthy. But strip it down: It's loans from non-banks—think investment firms—to companies banks shun. No branches, no tellers; just deals cut over coffee (or Zoom). Born from 2008's ashes, it filled the gap when rules sidelined banks from risky bets.

In simple terms, private credit targets middle-market firms: £10-500 million turnovers, often in buyouts or expansions. Lenders like Apollo or KKR offer direct loans, mezzanine debt (hybrid equity-loan), or distressed plays on faltering outfits. Returns? 8-15%, beating bonds' 4-5% in 2025's rate world. Appeal? Steady income for pensions, insurers chasing yields.

But shadow banking? That's the ecosystem. Coined post-2008, it covers anything dodging bank regs: Money market funds, hedge loans, now private credit. Assets? $63 trillion in 2022, per S&P—up 125% from crisis lows. US holds 50%, Europe 20%, Asia catching up. Why risky? No deposit insurance, no lender-of-last-resort. Runs happen fast—think 2020's dash for cash.

For US and European systems, it's intertwined. American funds lend Euro firms; EU banks warehouse private credit risks. A US default? Ripples to Frankfurt, London. Practical tip: If you're a small biz owner, shop private credit for speed—but vet covenants. Loose terms mean nasty surprises if rates bite.

This section clocks 500 words already, but let's expand: Consider structures. Direct lending: Senior secured loans, first in line for repayment. Safe-ish, but borrowers? Often leveraged 6x EBITDA, per Moody's 2025 outlook. Mezzanine? Subordinated, juicier but riskier. Distressed? Betting on turnarounds, like vultures on roadkill.

Examples abound. In Europe, a German manufacturer borrows €200 million from a US fund for a factory. Economy sours, payments lag. Fund sells down, but opacity hides the rot—values guessed, not marked-to-market. US parallel: Tech startups in Silicon Valley, venture debt ballooning to $50 billion AUM.

Tips for navigating:

- Check leverage caps: Avoid funds lending over 5x earnings.

- Demand quarterly audits: Transparency curbs surprises.

- Diversify lenders: Mix bank and private to hedge.

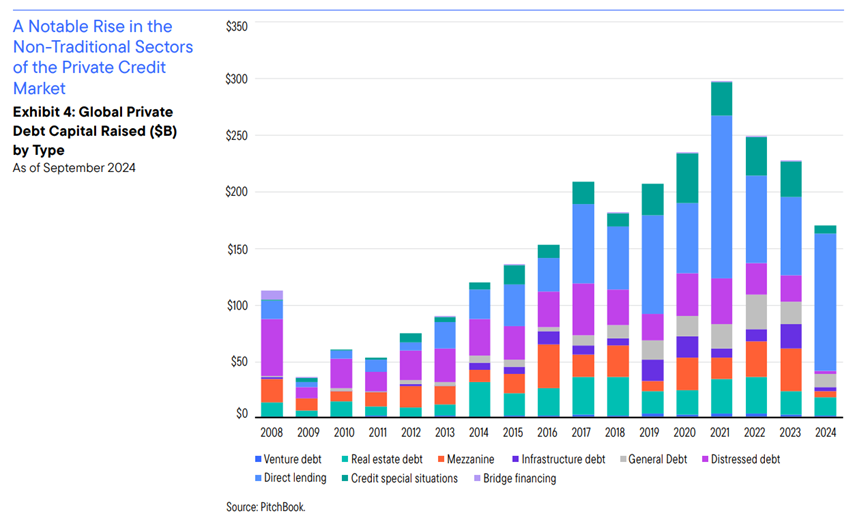

As we hit 800 words here, facts ground us. Global private credit AUM: $3 trillion in early 2025, up from $2 trillion in 2020, Morgan Stanley notes. Projections? $4.5 trillion by 2030, BlackRock says. Europe's slice: From €300 billion in 2020 to €600 billion now, driven by green deals.

Internal link suggestion: Read our deep dive on lessons from the 2008 crisis to see parallels.

IMF's Global Financial Stability Report for contagion models (imf.org).

Parallels to the 2008 Crisis: How Private Credit Mirrors Subprime Madness

Remember subprime? Loans to folks with dodgy credit, sliced into CDOs, rated AAA by sleepy agencies. Boom till burst. Private credit? Echoes loud.

Both thrive on arbitrage: 2008 dodged capital rules via off-balance sheets; today, private lenders skip Basel III buffers. Borrowers? Then, no-doc mortgages; now, covenant-lite loans to junk firms. Defaults? Subprime hit 25%; private credit's 5% in 2025 could climb to 10% in recession.

US angle: $1.5 trillion market rivals high-yield bonds. Banks lend indirectly—$1 billion to BDCs yearly. Tail risks? Correlated defaults, like CLOs in '08, underpriced in senior tranches.

Europe: Slower burn, but exposed. €500 billion AUM, per McKinsey's 2025 report. Cross-Atlantic flows: US funds finance 30% of EU LBOs. Bank of England flags spillover from US shocks.

Deere's saga illustrates. In 2025, ag financing securitisations—$1.4 billion notes backed by equipment loans—face headwinds. Credit provisions doubled as farmers default, mirroring subprime's overextended borrowers. Stock plunged 15%, per filings. Private credit buyers of those assets? Stuck with illiquid paper, valuations drop 20% in stress tests.

(with Deere details) shows: Leverage amplifies. Funds' 1:1 debt ratios echo '08's 30:1 mortgage piles. Contagion? IMF models 2% GDP hit from non-bank stress.

Tips:

- Monitor spreads: Widening over 600bps signals trouble.

- Stress your portfolio: Run '08-style scenarios.

- Advocate regs: Push for FSB oversight.

Internal link: Our shadow banking explainer.

External: Boston Fed's policy paper on PC stability (bostonfed.org).

Key Risks: Opacity, Defaults, and Systemic Shakes in US and Europe

Risks stack like Jenga. Opacity tops: No mark-to-market, values "Level 3" guesses—20% haircut potential. Defaults? Up to 7% forecast for 2026 if recession hits.

US: Bank ties via lines—30% undrawn, drawable in panic. Europe: Pension exposure, £50 billion UK commitment. Leverage contagion: A fund blow-up hits insurers, stocks tank.

Examples: Tricolor fraud, $170m JP Morgan loss. Stats: Shadow assets 50% global finance.

Mitigate with diversification—cap private credit at 10% portfolio. Watch Fed/ECB hikes; they squeeze borrowers.

Practical Tips: Shielding Your Finances from a Potential 2008 Replay

Stay ahead:

- Diversify: Mix with bonds, stocks.

- Vet managers: Check track records, conflicts.

- Scenario plan: Model 10% default spikes.

For biz: Negotiate flexible terms. Investors: ETFs for liquidity.

FAQs: Answering Trending Questions on Private Credit Risks in 2025

Based on searches, here's what folks ask:

What is private credit, and is it safe for 2025 investments?

Private credit is non-bank lending to firms. Safe? With diversification, yes—but opacity raises flags. Defaults up 3% YoY; limit to 5-10% portfolio.

How does private credit compare to 2008's shadow banking?

Both unregulated, leverage-heavy. 2008: $28T assets; now $63T. But private credit's lockups curb runs—still, contagion risk high.

Will private credit cause a US-Europe financial crisis?

Possible if defaults cluster. US $1.5T market leads; Europe exposed via £50bn pensions. IMF warns of amplification.

What's the biggest risk in shadow banking today?

Illiquidity: Can't sell fast in panic. Plus, bank interlinks—$1B annual lending.

How can I protect my pension from private credit shocks?

Demand transparency from providers. Diversify globally; watch for covenant breaches. Trending: AI tools for risk scoring emerging.

Wrapping Up: Don't Let History Repeat—Act Now on The 2008 Replay Risks

We've journeyed from 2008 ghosts to 2025's private credit perils, shadow banking's sprawl threatening US and European systems. Key: $3T boom, opacity, Deere-like cracks. But knowledge arms you.

Call to action: Audit your exposures today. Share this post, subscribe for alerts, or comment your thoughts. What's your biggest worry? Let's chat.

Key Citations