US-Iran Oman Talks: Why Oil Prices Are Falling

US-Iran Oman Talks 2026: Why Crude Oil Prices Are Falling Today and What It Means for the Global Market

- Oil prices are dropping today due to the US and Iran agreeing to nuclear talks in Oman, easing fears of Middle East conflict and supply disruptions.

- Brent crude stood at around $67.50-$68.50 per barrel on 5 February 2026, down over 3%, while WTI hovered near $63–64 per barrel.

- The geopolitical risk premium is fading as diplomacy progresses, potentially leading to a more stable oil supply through the Strait of Hormuz.

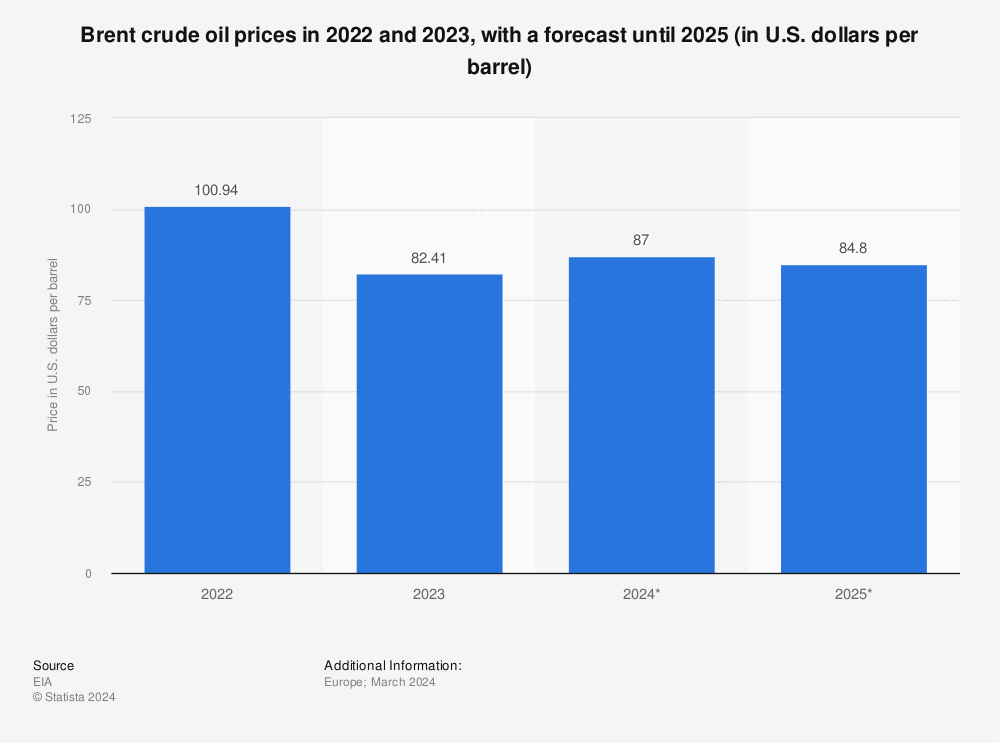

- Forecasts from the IMF and World Bank suggest average Brent prices could fall to $60–65 per barrel in 2026, driven by ample supply and easing tensions.

- Broader impacts include lower costs for oil-importing nations like India, though volatility remains if talks stall.

Current Oil Price Snapshot As of 5 February 2026, Brent crude has fallen amid news of the talks, reflecting market relief over potential de-escalation.

Why Prices Are Falling Today The agreement to hold talks has reduced the "fear factor" in markets, lowering the premium tied to possible supply risks.

Looking Ahead While short-term relief is clear, long-term prices depend on negotiation outcomes and global demand.

The recent developments in US-Iran diplomacy have sent ripples through the global energy markets. On 5 February 2026, crude oil prices dropped noticeably as news broke that the United States and Iran had agreed to hold nuclear talks in Oman. This marks a significant moment in international relations, especially under the Trump administration, which has taken a firm stance on Iran's nuclear programme, ballistic missiles, and regional influence.

The talks, scheduled for 6 February in Muscat, Oman, come after a period of heightened tensions. President Trump has warned Iran's Supreme Leader to be "very worried" if no progress is made, while the US seeks a comprehensive deal beyond just nuclear limits. Oman, known for its neutral role in Middle East diplomacy, has once again served as the host, facilitating indirect and now direct engagement.

This diplomatic breakthrough has directly influenced oil markets. Brent crude fell toward the $68 mark, a decline of over 3% from recent highs, while WTI crude dropped to around $63.23 per barrel. Markets reacted swiftly because any easing of tensions between the US and Iran reduces the perceived risk to oil flows through the Strait of Hormuz.

The Strait of Hormuz ranks among the most strategically important oil chokepoints in the global energy system. Around 20–30% of the global seaborne oil trade passes through this narrow waterway between Iran and Oman. Any threat to close it – as Iran has hinted at in the past – can spike prices due to fears of shortages. With talks underway, that risk premium has started to unwind, allowing prices to fall.

Why Are Oil Prices Falling Today?

The main driver is simple: reduced geopolitical uncertainty. When the US and Iran confirmed the Oman meeting, traders sold off positions built on conflict fears. Reuters reported Brent futures down $2.33 (3.35%) at one point, with similar moves in WTI. This is classic market behaviour – prices often drop on de-escalation news, even if no final deal is reached.

Other factors play a role, too. Global supply remains ample, with OPEC+ production steady and non-OPEC output (especially US shale ) robust. Demand growth is modest amid economic uncertainties, adding downward pressure.

The Impact of US-Iran Diplomacy on Oil Supply

Diplomacy can reshape oil supply dynamics. If successful, talks could lead to sanctions relief for Iran, allowing it to increase exports. Iran currently produces around 3–3.5 million barrels per day, but has capacity for more. Higher Iranian supply would further weigh on prices.

Conversely, failure could reignite tensions, raising risks around the Strait of Hormuz and pushing prices up. The Trump administration wants concessions on missiles and proxies, making the outcome uncertain.

Brent and WTI are the two main benchmarks. Brent, sourced from the North Sea, reflects global prices, while WTI is US-centric.

Table: Recent and Forecasted Prices (USD per barrel)

| Source/Date | Brent Current (Feb 2026) | WTI Current (Feb 2026) | 2026 Average Forecast (Brent) |

|---|---|---|---|

| Market Data (5 Feb 2026) |

| ~63.23 | - |

| IMF (Jan 2026) | - | - | ~62.13 |

| World Bank (Oct 2025) | - | - | ~60 |

| EIA (Recent) | - | - | ~56–65 |

Prices are down from earlier highs, with forecasts pointing lower due to a supply glut and diplomatic tensions.

Geopolitical Risk Premium Explained

The "risk premium" is the extra amount traders add to prices for potential disruptions. In calm times, it's low; during crises, it can add $10–20 per barrel. The Oman talks have trimmed this premium, contributing to today's drop.

Mini Case Study: Impact on India's Economy

India, one of the world's largest oil importers, relies on Middle East crude for over 80% of its needs. Lower prices reduce the import bill, easing inflation and supporting the rupee. In past dips (e.g., 2020), India's fuel costs fell, boosting consumer spending and growth. If prices average $60 in 2026, India could save billions, helping its fiscal balances. However, prolonged low prices might hurt domestic producers like ONGC.

Broader Global Oil Market Geopolitics

The talks highlight Oman's role as a mediator. Broader issues – sanctions, proxies – could influence outcomes. The Federal Reserve notes that energy prices affect inflation, while IMF projections show that low oil prices aid global growth by lowering consumer costs.

FAQs

Why are oil prices falling today? The US-Iran talks in Oman have eased supply disruption fears, causing a sell-off.

What is the status of the Trump administration's Iran talks for 2026? Talks are set for 6 February in Oman, focusing on nuclear issues and more.

Why does the Strait of Hormuz play such a key role in oil pricing?

It's a key transit point; threats to it raise prices due to supply risks.

Will Brent crude fall further in 2026? Forecasts suggest yes, to $60–65 average, if supply stays high and tensions low.

What should investors watch? Talk outcomes, OPEC decisions, and demand data.

Conclusion

The US-Iran Oman talksof 2026 have brought welcome relief to oil markets, driving today's crude oil price drop. While Brent and WTI have fallen amid fading risks, the path ahead depends on negotiation success. For now, lower prices benefit consumers and importers, but volatility lingers. Stay informed on global oil market geopolitics – subscribe for updates or share your thoughts below!

Disclaimer: All content published on Marqzy is for educational and informational purposes only and should not be construed as financial advice. We are not SEBI-registered financial advisors. Investments in the stock market, mutual funds, or other financial instruments carry inherent risks. Please seek advice from a qualified financial professional and perform independent due diligence before investing. Marqzy shall not be held liable for any financial loss incurred.

Key Citations

- https://www.reuters.com/business/energy/us-oil-prices-fall-ahead-us-iran-talks-2026-02-05

- https://www.bbc.com/news/articles/cvgj2knp4d9o

- https://tradingeconomics.com/commodity/brent-crude-oil

- https://www.worldbank.org/en/news/press-release/2025/10/28/commodity-markets-outlook-october-2025-press-release

Comments

Post a Comment