Trump’s 2026 Trade Order: AI & Global Impact

Trump's 2026 Trade Shake-Up: Tariffs, the Global Economy, AI Risks, and EU Tensions Explained

Trump's tariffs in 2026 are reshaping global trade, with a focus on reciprocity to protect American jobs and industries. These policies, often called the "new trade order," include higher duties on imports from China, Europe, and others, plus specific tariffs on advanced semiconductors critical for AI.

Key Points

- Trade policy has become more protectionist under the Trump administration, with reciprocal tariffs of up to 15–34% and targeted AI chip duties. While these steps may boost U.S. revenues, studies warn they risk slowing global growth.

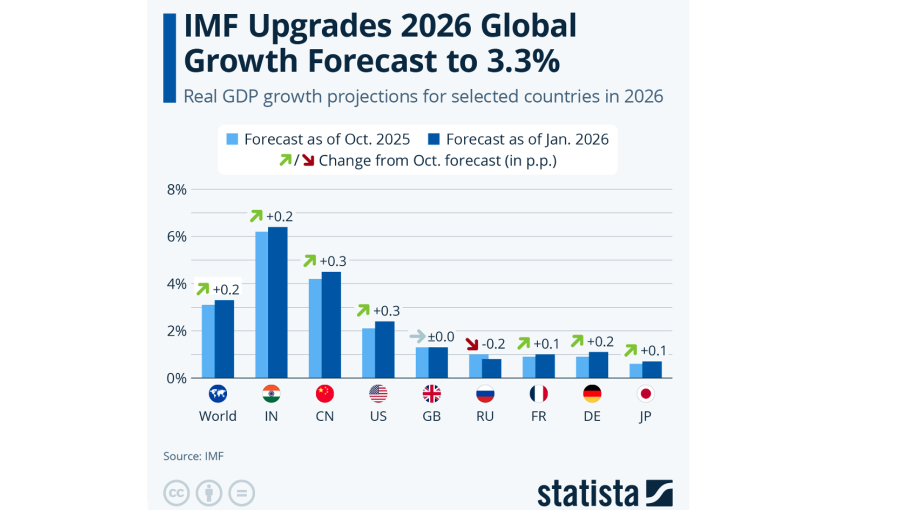

- The IMF expects global growth to hold at 3.3% in 2026, with AI momentum helping offset trade pressures. The U.S. economy is projected to grow 2.4%, outperforming many advanced peers.

- AI investments carry new risks: Tariffs on chips like NVIDIA’s H200 could disrupt supply chains and raise costs, though exemptions exist for some US uses. Evidence leans toward heightened volatility if trade flare-ups worsen.

- EU faces challenges: The bloc is preparing countermeasures and strengthening ties elsewhere (e.g., India) amid US tariffs on select European nations.

- Real-world impact: Companies like John Deere expect heavy tariff costs, highlighting broader effects on agriculture and manufacturing.

These changes highlight a complex balance: protecting domestic industries while navigating global risks. Views differ—supporters see long-term gains for US workers, while critics warn of higher prices and slower growth.

Key Takeaways

Under Trump’s “new trade order,” reciprocal tariffs and targeted duties on technology are being used to defend U.S. economic and security interests.

- Global growth holds steady at 3.3% in 2026, aided by AI advances despite trade headwinds (IMF data).

- Chip tariffs pose supply-chain and cost risks for AI investment.

- In response, the EU is considering retaliatory actions while pursuing new strategic partnerships.

- Companies like John Deere show real pain from higher import costs.

Introduction

Imagine waking up to news that your smartphone or tractor just got more expensive overnight. That’s the reality many businesses and consumers are facing in 2026 under President Trump’s latest trade moves. Since taking office again, the administration has pushed hard for what some call a “new trade order”—a set of tough tariffs designed to make trade “fair” for America.It started with big announcements in January 2026: reciprocal tariffs matching what other countries charge the US, plus special duties on advanced computer chips used in AI. The goal? Bring jobs back home, strengthen national security, and cut trade deficits. But these steps have ripple effects worldwide.

Will the AI boom be strong enough to support global growth amid potential economic risks? What impact could tariffs have on AI-related investments? And what’s the EU doing about it? This post dives deep into these questions with clear facts, examples, and tips. We’ll look at reliable sources like the IMF and real cases to help you understand what’s happening and what it might mean for you.

What Is the Trump Administration’s New Trade Order?

The “new trade order” isn’t an official name, but it describes Trump’s 2026 approach: using tariffs to force fairer deals. Key actions include:Reciprocal tariffs typically peak around 15%, but for countries like China, discounted-rate structures can push them as high as 34%.

- Under Section 232, a 25% tariff applies to certain advanced semiconductors (e.g., NVIDIA H200, AMD MI325X) for national security reasons, while components intended for U.S. domestic use are exempt.

- The U.S. is set to introduce additional import duties on eight European countries as part of a dispute involving Greenland and trade imbalances, with rates starting at 10% and potentially rising if talks stall.

These new policies expand on prior trade actions. The administration frames them as protection for U.S. workers and supply chains, whereas critics highlight the risk of higher import costs and broader price pressures.

What Are the Global Economic Effects of These Policies in 2026?

The IMF’s January 2026 update paints a mixed but steady picture. Global growth is forecast at 3.3% for 2026—similar to recent years—and slightly up from earlier estimates. Rapid growth in AI and technology is helping absorb shocks from trade disruptions.Economic growth in the United States is projected at 2.4%, supported by fiscal incentives and continued investment in artificial intelligence, while advanced economies collectively are expected to grow at 1.8%. But risks remain: trade flare-ups could slow things down, and an AI market correction might hurt confidence.

Here’s a quick look at growth forecasts:

| Region | 2026 Growth (%) | Key Notes |

|---|---|---|

| World | 3.3 | Resilient despite tariffs |

| United States | 2.4 | Boosted by AI and policy |

| Advanced Economies | 1.8 | Slower than emerging markets |

| Euro Area | ~1.2 | Trade tensions a drag |

(Source: IMF World Economic Outlook Update, January 2026)

Tariffs are raising US revenues (estimates of $175-247 billion in 2026), but they may cut GDP slightly by making imports costlier.

AI Investment Risks in the Age of Trade Tensions

AI has been a bright spot, driving growth and valuations sky-high. But tariffs on advanced chips create real risks.In a bid to strengthen national security and boost domestic manufacturing, the U.S. introduced 25% duties on specific AI semiconductors. Although exemptions apply in some cases, global supply chains—particularly those linked to Taiwan and China—are encountering added costs and delays.

This is accelerating China’s push to develop its own AI technologies, raising investor concerns about:

- Sudden market corrections if AI firms miss earnings targets.

- Higher costsare slowing AI adoption in businesses.

- Geopolitical risks disrupting chip supplies.

The World Economic Forum identifies tariffs and AI-related risks as the top global threats in 2026. If trade tensions ease, AI could keep booming; if not, volatility rises.

EU Trade Policy: Response and Challenges

The planned 10% tarif.f The situation remains fluid as negotiations continue (set for February 1) and the subsequent 25% escalation (set for June hasave been officially withdrawn.The bloc is:

- Preparing countermeasures while seeking talks.

- Signing deals elsewhere, like with India, to reduce US dependence.

- Holding off on some US-EU trade progress until threats subside.

Trade between the EU and the US (around €1.1 trillion yearly) has slowed. The EU wants fair play but fears a full trade war.

Mini Case Study: John Deere and the Tariff Squeeze

John Deere, the famous US tractor maker, shows how tariffs hit everyday industries. In late 2025, the company warned of a $1.2 billion pre-tax tariff hit in fiscal 2026—double the 2025 figure.Why? Tariffs raise costs for steel, parts, and imports. Farmers face higher equipment prices, cutting demand. Deere forecasts weak profits and no quick farm recovery.

This echoes past trade tensions: sales drop, stocks suffer, jobs feel pressure. Yet Deere invests in tech to stay competitive. It’s a reminder that protectionism helps some sectors but hurts others.

Practical Tips for Navigating 2026 Trade Changes

- Investors: Diversify away from heavy tariff exposure (e.g., chips, agriculture). Watch AI firms for supply news.

- Businesses: Check supply chains for tariff risks; consider local sourcing.

- Everyone: Expect slightly higher prices on imported goods—budget accordingly.

FAQs

What are the main Trump tariffs in 2026? The measures include reciprocal tariffs ranging from 20% to 34% on EU and China imports, in addition to 25% tariffs on specific AI semiconductors.Will tariffs crash the economy? Unlikely—IMF sees steady growth—but risks like slower trade exist.

How do tariffs affect AI stocks? They raise chip costs and add uncertainty, potentially leading to volatility.

Is the EU fighting back? Yes, with possible duties and new deals to reduce reliance on US trade.

What should investors do? Stay informed via IMF reports and diversify portfolios.

Conclusion Trump’s 2026 trade policies aim to put America first, but they bring trade-offs: stronger US manufacturing versus global risks. The economy looks resilient thanks to AI, yet challenges remain for investments and partners like the EU. John Deere’s story reminds us that real people and businesses feel these changes.

Stay updated on trade news, review your investments, and consider how global shifts affect your wallet. What do you think these policies mean for the future? Let us know what you think in the comments and subscribe for more insights!

Key Citations

Comments

Post a Comment