Key Takeaways

- Earnings season in Q3 2025 could show if big tech firms are making money from their huge AI investments, deciding if the AI trade keeps booming or slows down.

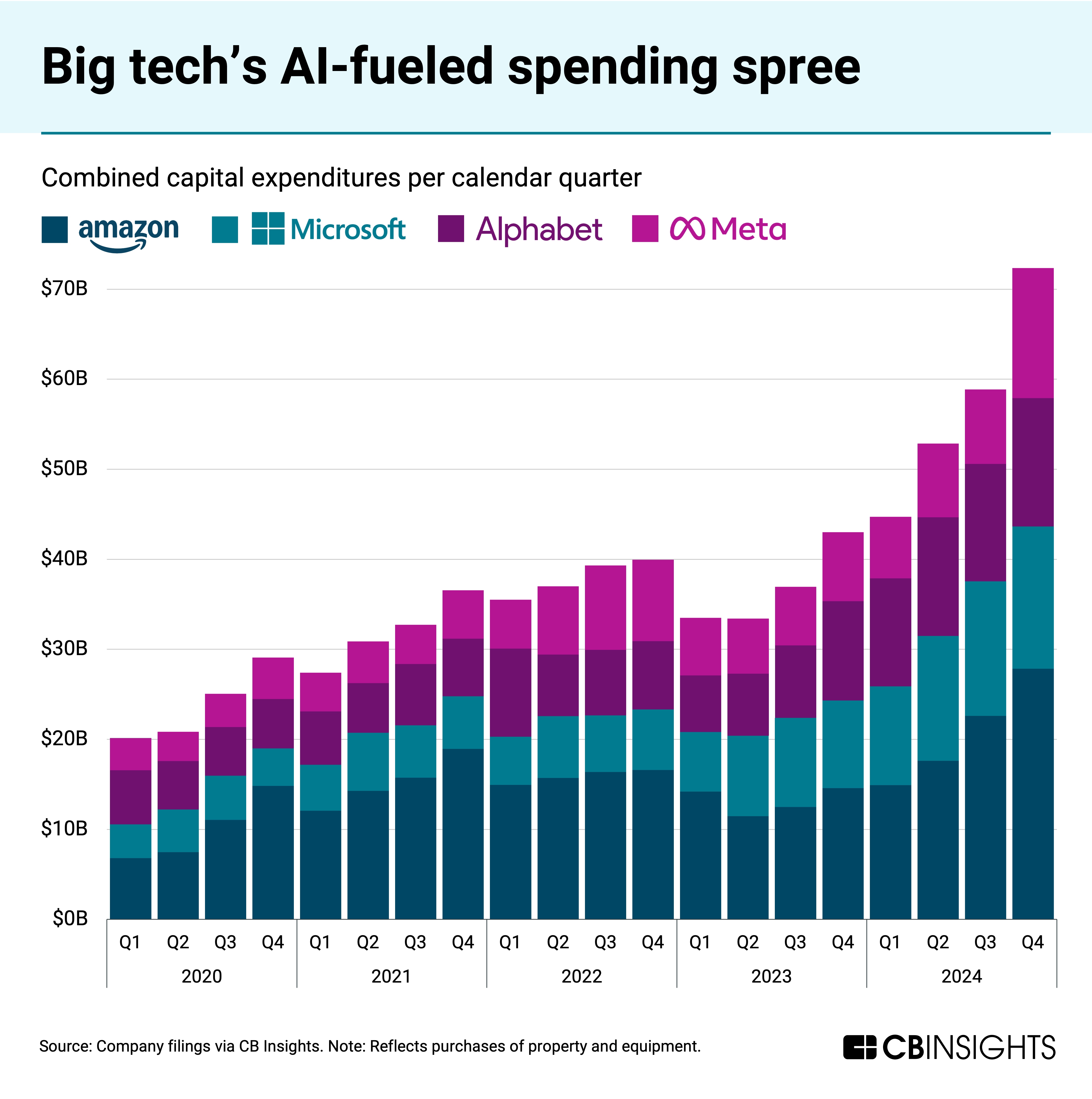

- CapEx, or capital spending on AI tools like data centres and chips, is rising fast but might hurt profits if it doesn't pay off soon.

- Companies outside tech, like John Deere, are using AI in farming, showing the AI trade isn't just about tech giants.

- Experts warn of a possible slowdown in AI spending, but strong earnings could boost stocks like Nvidia and Microsoft.

- Investors should watch for balanced views, including risks like market bubbles, to make smart choices.

Introduction

Hey there, have you been keeping an eye on the stock market lately? It's October 2025, and things are getting exciting – or maybe a bit scary – with the AI trade. You know, that big rush where everyone is investing in artificial intelligence stocks because AI seems like the next big thing. But here's the hook: the upcoming earnings season and how companies spend on capital expenses, or CapEx, could really make or break this whole AI investment craze.

Let me explain what I mean. Earnings season is that time every three months when companies tell the world how much money they made or lost. It's like report card day for businesses. Right now, we're heading into Q3 2025 earnings, and all eyes are on tech giants like Microsoft, Amazon, Google, and Meta. These firms have been pouring billions into AI – think building massive data centres, buying super-fast computer chips, and developing smart software. This spending is called CapEx, short for capital expenditures. It's money spent on big, long-term stuff to grow the business.

Why does this matter for the AI trade? Well, the AI trade is basically betting that AI will change everything and make these companies super rich. Stocks like Nvidia have skyrocketed because they make the chips that power AI. But if earnings reports show that all this CapEx isn't turning into real profits yet, investors might get nervous. On the flip side, if companies report big wins from AI, the trade could keep soaring.

Take a step back. AI isn't new, but it's exploded since 2023 with things like ChatGPT. Companies saw the potential and started spending like crazy. In 2024, big tech's combined CapEx hit record levels, often over $100 billion a quarter just on AI stuff. That's huge! But experts are debating if this is a smart move or a bubble waiting to pop, like the dot-com crash in 2000.

In short, earnings and CapEx are pivotal. If reports show AI paying off, stocks rise. If not, a pullback. Stay tuned – this could define 2025 markets.

Understanding Earnings Season in 2025

Earnings season is when public companies share their financial results. It happens four times a year, after each quarter. For Q3 2025, it starts in mid-October and runs into November. Big banks like JPMorgan and Wells Fargo kick it off, then tech firms follow.

Key Dates and Companies to Watch in the AI Trade

Look out for these: Microsoft reports on October 30, Amazon on October 31, and Nvidia in late November. These dates matter because they reveal if AI is boosting revenues.

In earnings calls, bosses talk about future plans. If they say AI CapEx will keep growing, that's good for the trade. But if they hint at cuts, watch out.

Practical tip: Use free tools like Yahoo Finance to track calendars. Set alerts for your favourite stocks.

Bullet points on what to listen for:

- Revenue growth from AI products.

- CapEx plans for next year.

- Any talk of AI monetisation, like selling more cloud services.

- Warnings about costs or competition.

Stats show Magnificent Seven earnings could be robust, driving market highs. But overall, S&P growth is softer at 4%.

The Role of CapEx in AI Investments

CapEx is money companies spend on big assets like buildings or equipment. In AI, it's mostly for data centres, GPUs (graphics processing units), and software.

How CapEx Fuels the AI Trade

Big tech is spending wildly. Hyperscalers like Amazon, Microsoft, Google, and Meta plan $430 billion in 2026. This builds the backbone for AI apps.

Example: Nvidia's chips are key. Their sales jumped because of CapEx demand. But it's not just tech. AI CapEx is 40% of S&P 500 spending now. Growing 22% yearly, double the average.Risks of High CapEx

If spending outpaces profits, it hurts free cash flow. Some say it could cripple S&P profits. Depreciation – writing off asset costs over time – eats into earnings.

On X, @BobEUnlimited noted AI CapEx added 1% to GDP but might peak.Tips: Check company balance sheets for CapEx vs. cash flow. If negative, red flag.

Bullet points on benefits:

- Builds future growth.

- Creates jobs in tech.

- Makes AI cheaper over time.

Potential Risks and Rewards for the AI Trade

The AI trade has rewards like high stock gains. NVIDIA is up big on AI chips.

Rewards from Strong Earnings and CapEx

If earnings show AI boosting cloud sales, stocks rise. Google Cloud grew 32%. CapEx leads to better products, like smarter search.

Expert view: Goldman Sachs says AI drove 26.6% growth for top tech.Risks if Things Go Wrong

Slow CapEx could signal weak demand. Kersmanc warns of tapering if returns drop. Competition from Oracle cuts margins.

Bubble talk: CapEx at 50-70% of EBITDA, like past bubbles.Tips: Diversify – don't put all in one stock. Look for counter views on X.For a balanced view, some say AI is underbuilt.

Case Study: John Deere's AI CapEx Example

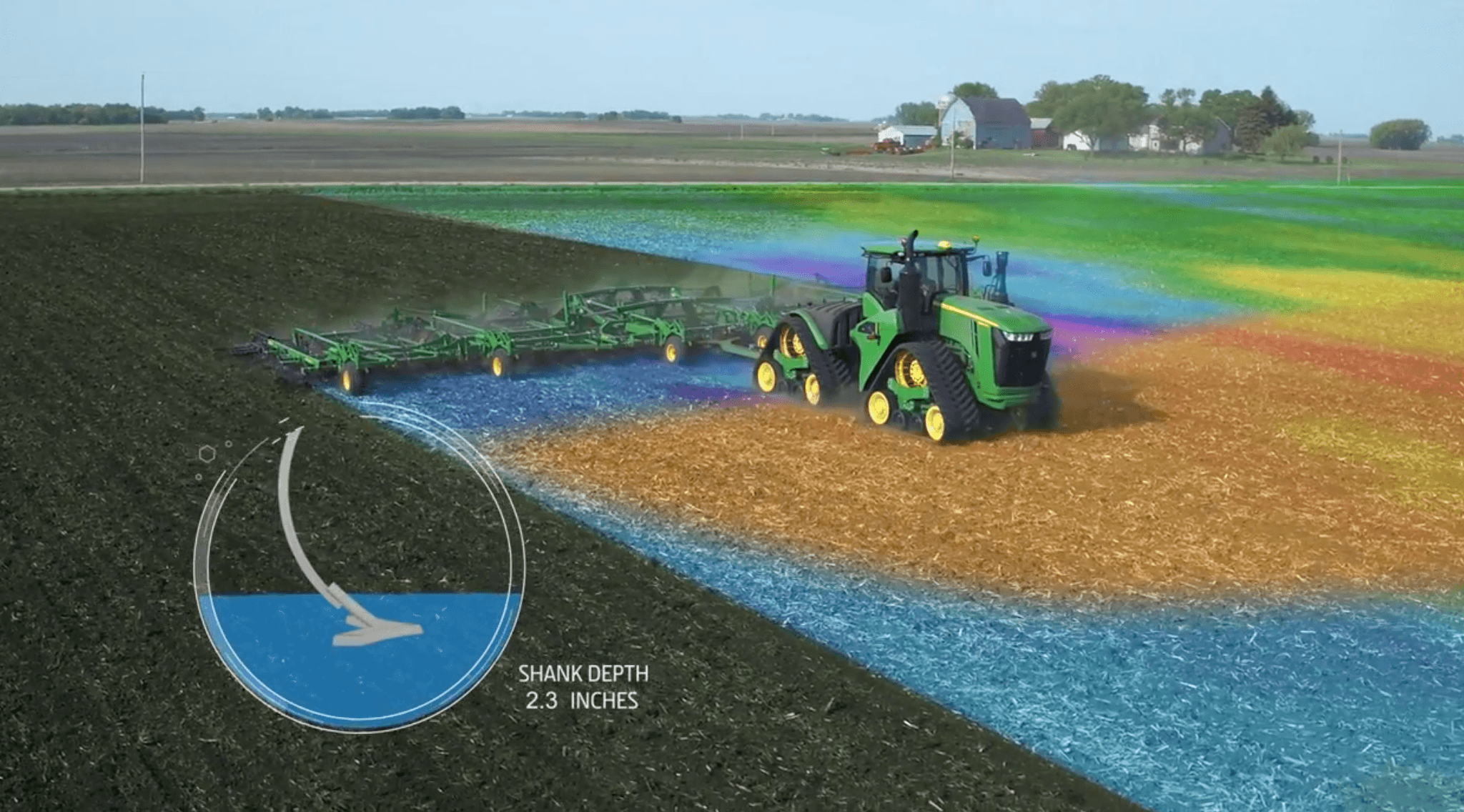

John Deere, the tractor maker, is a hidden gem in the AI trade. They use AI for smart farming, not just tech gadgets.

How Deere Invests in AI

Deere spends on AI for predictive tools. Using data from tractors, AI spots the best planting spots. Their CapEx includes buying AI firms like Blue River Tech for weed-spraying robots.

In 2024, investing cash outflows were $6.5 billion, part of AI growth. CapEx growth was 8% last year.AI Applications in Farming

AI helps farmers save money. Deere's See & Spray uses cameras and AI to spray only weeds, cutting chemical use by 77%. Location intelligence predicts market growth.

Example: In one field, AI adjusts seed depth based on soil, boosting yields.

Stock Performance and Analyst Views

Deere stock hit an all-time high in 2025, targeting $700. Analysts see it as an undervalued AI play.

But risks: Farm economy down, stock dipped 6.49% recently.Tips: If earnings show AI sales up, buy Deere. It's practical AI.

This case shows AI trade's broad appeal. Deere's CapEx in AI could pay off big if farming goes high-tech.

Expert Opinions and Market Predictions

Experts like Kersmanc see CapEx as key. Goldman notes AI in healthcare, cutting trial costs by 30% by 2030.

On X, @munster_gene says watch CapEx updates.Predictions: AI CapEx to $500 billion in 2025. But a slowdown could drag the market.

For more on AI stocks, check our Guide to Beginner Investing in AI and Top Tech Trends 2025. External sources: Yahoo Finance on AI Trade and Goldman Sachs Insights.

Conclusion

To wrap up, earnings season and CapEx are crucial for the AI trade. Strong reports could push stocks higher, but weak ones might cause a rethink. We've seen how CapEx drives growth but risks profits, with examples like Deere showing real-world use.

Stay informed – the market could shift fast. If you're interested, subscribe to our newsletter for weekly updates on AI investments. What do you think – is the AI trade a winner or over-hyped? Let us know!

Citations: