Toyota’s Hidden Powerhouse: The After-Sales Revolution

Key Takeaways

- Toyota's value chain arm, focused on after-sales services, parts, and connected tech, keeps 150 million vehicles on the road and generates steady profits.

- In the fiscal year ending March 2026, this arm is expected to surpass profits from new car sales, marking a shift to more stable income sources.

- With an annual growth of about ¥150 billion in operating profit, Toyota's strategy leverages maintenance, used cars, and financing for long-term success.

- Compared to John Deere, Toyota's model shows how after-sales can be 3-6 times more profitable than core product sales.

- Owners can save money and extend car life by using official Toyota services, with tips on regular maintenance and connected features.

Introduction

Have you ever wondered what happens after you drive your new Toyota off the lot? Most people think about the thrill of a fresh car, but for Toyota, that's just the start. Toyota's after-sales arm – the part that handles repairs, parts, and services – is quietly becoming the company's biggest money-maker. This "arm" keeps an amazing 150 million Toyota vehicles running smoothly on roads around the world. And guess what? It's not just about fixing cars; it's a smart business that earns billions and is set to beat profits from selling new cars.

Let's dive into this. Toyota, one of the world's top car makers, has built a huge network of services. This includes everything from oil changes and tyre replacements to advanced connected tech that monitors your car's health. With 150 million cars out there – that's like every person in Russia owning one – Toyota has a massive base to work with. These cars need regular care, and that's where the money comes in. In fact, recent reports show this arm hit a record ¥2 trillion (about $13.3 billion) in operating profit for the first time. That's a lot of cash from things like spare parts and warranties.

Why is this important? The car industry is changing fast. Electric vehicles, self-driving tech, and tough competition mean selling new cars isn't as reliable for profits anymore. Toyota saw this coming and focused on what happens after the sale. Their value chain arm includes financial services like loans and insurance, plus used car sales and connected services that send data from your car to help with maintenance. This creates a steady flow of income, even when new car sales dip.

Think about it like this: when you buy a Toyota, you're not just getting a car; you're joining a system that supports you for years. Toyota's strategy is to make cars last longer – their vehicles are known for reliability – so owners keep coming back for services. This builds loyalty and brings in repeat business. For example, in FY2025, Toyota's total operating income was 4,795.5 billion yen, and the value chain contributed significantly with expansions in parts and services.

But how did Toyota get here? It started with their famous production system, which emphasises efficiency and quality. Over time, they expanded into services. Now, with connected cars, they can predict when parts need replacing, making services more efficient. This arm grows by about ¥150 billion each year in profit, showing steady progress. For investors, this is exciting because it's less risky than relying on new sales, which can fluctuate with the economy. In today's world, where sustainability matters, keeping cars on the road longer reduces waste. Toyota's arm helps by providing genuine parts that extend vehicle life. Plus, with electrified vehicles making up nearly half of their sales – 4,748 thousand in FY2025 – services include battery checks and software updates. This positions Toyota as a leader in mobility, not just cars.

As we explore further, you'll see how this arm works, its numbers, and even a comparison to John Deere, who does something similar with tractors. Whether you're a Toyota owner, an investor, or just curious about business, this story shows how smart companies turn everyday services into gold mines. Stick around for tips on making the most of Toyota's services and what the future holds. By the end, you'll appreciate why Toyota's after-sales arm is the real hero keeping millions moving.

What Is Toyota's Value Chain Arm?

Toyota's value chain arm is like the backbone of the company after you buy a car. It's not just one department; it's a whole system that includes after-sales services, spare parts supply, financial help like loans, and even connected tech. This arm makes sure your Toyota stays reliable for years.

The Core Components of Toyota's After-Sales Services

At the heart are the service centres. These places offer routine maintenance like oil changes, brake checks, and tyre rotations. Toyota has thousands of authorised dealers worldwide, ensuring help is nearby. For instance, in the UK, you can find Toyota centres in most big cities, offering quick fixes.

Then there's the parts business. Toyota supplies genuine parts that fit perfectly and last longer. This avoids problems from cheap copies. In FY2025, parts and accessories contributed to the value chain's growth.

Financial services are another key part. Toyota helps with car loans, insurance, and leasing. This arm earned 673.7 billion yen in operating income in FY2025, up from the previous year. It's like Toyota stays with you through the ownership journey.

Connected services use tech to monitor cars. Apps like Toyota Connected let you check fuel levels or find your car. This data helps predict repairs, saving time and money.

How It Supports 150 Million Vehicles

With 150 million Toyota cars on the road, this arm is busy. That's a huge number – more than the population of many countries. These vehicles range from old Corollas to new Prius hybrids. The arm ensures parts are available even for older models.

Toyota's strategy is to make cars durable. The average Toyota lasts over 200,000 miles with proper care. Services include warranty extensions and roadside help. In Asia, where Toyota sells a lot, services adapt to local needs like hot weather maintenance.

This scale brings economies – buying parts in bulk reduces costs, passed on to customers. It also creates jobs in service centres globally.

The Impressive Numbers Behind Toyota's Success

Numbers tell the story best. Toyota's value chain arm is a profit machine.

Operating Profits and Growth Trends

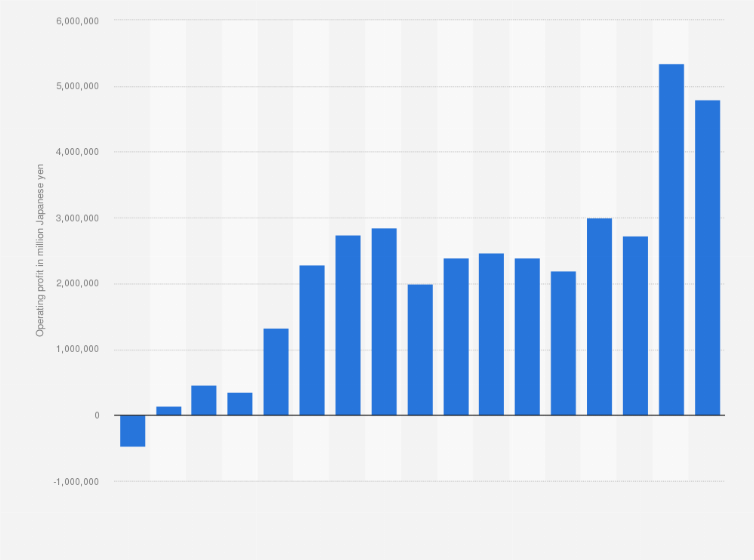

In FY2025, Toyota's overall operating income was 4,795.5 billion yen. The value chain arm played a big role, expanding by ¥150 billion annually. It reached ¥2 trillion in profit recently, a record.

For FY2026, it's projected to top ¥2 trillion and exceed new car sales profits. This shift is huge – from volatile sales to stable services. Vehicle sales were 9,362 thousand in FY2025, with retail at 11,011 thousand. Electrified models are 46.2% of sales, needing special services like battery care.

Regional Breakdown and Global Impact

Japan leads with 3,484.2 billion yen in operating income. North America and Asia follow. This shows Toyota's global reach.

With 150 million units in operation, the arm taps into a vast market. Used car sales and accessories add to profits.

Lessons from John Deere:

Toyota isn't alone in this approach. John Deere, the tractor giant, has a similar after-sales model that's super profitable. Let's compare to see why it works.

John Deere makes tractors and farm equipment. Like Toyota, their repair business is key. Company filings show repairs are 3 to 6 times more profitable than selling new equipment. In 2020, Deere shared this with investors, highlighting high margins.

Why so profitable? Repairs use parts with high markups. The average margin on Deere parts is 28%, but some reach 60%. Filters are low at 4%, but overall, it's lucrative. Deere controls repairs tightly. Farmers often can't fix tractors themselves due to software locks. This forces them to use authorised services, boosting profits. A report says this costs US farmers $4.2 billion yearly in extra fees. The FTC sued Deere in 2025 over unfair repair tactics. In Q3 2025, Deere's net income was $1.289 billion, despite a sales drop. Financial services jumped 34% to $205 million. This mirrors Toyota's financial arm. For Deere, after-sales stabilises income. Farm income fluctuates with crops, but repairs are constant. In 2024, full-year earnings were $7.1 billion. Projections for 2025 are $5-5.5 billion, showing resilience.

Now, compare to Toyota. Both leverage large installed bases – Deere has millions of machines, and Toyota has 150 million cars. Both use tech: Deere's connected tractors send data, like Toyota's apps.

But differences exist. Deere faces "right-to-repair" backlash, pushing for open fixes. Toyota is more open, with many independent shops using their parts, though official services are preferred for warranties.

Profit-wise, Deere's model inspired Toyota. By focusing on services, Deere's stock rose, even in tough times. Toyota aims for 20% ROE through this shift. What can we learn? For companies, after-sales service builds loyalty and steady cash. For consumers, it means reliable support but higher costs if locked in. Open-source ideas, like those for tractors, could influence cars.

In summary, John Deere's success validates Toyota's path. Both show services can outshine core products in earnings.

How Toyota's Arm Keeps Cars on the Road

Toyota's arm uses smart ways to maintain vehicles.

- Regular Maintenance Tips: Change oil every 5,000-10,000 miles. Check tyres monthly.

- Connected Tech Benefits: Use apps for remote diagnostics.

- Genuine Parts Advantage: Last longer, better warranty.

In hot climates, extra cooling checks. For hybrids, battery health monitoring.

This extends car life, reducing environmental impact.

Future Projections for Toyota's Value Chain

Looking ahead, FY2026 forecasts 3,800 billion yen operating income, with a value chain over ¥2 trillion. Focus on SDVs and Woven City for new services.

Vehicle sales are projected at 9,800 thousand, with more EVs.

This arm will drive growth, making Toyota a mobility leader.

Practical Tips for Toyota Owners

- Schedule services regularly.

- Use Toyota apps for alerts.

- Consider extended warranties.

Internal links: Top Toyota Models for 2025, EV Maintenance Guide.

External: Bloomberg article on Toyota's arm, Toyota IR site.

Conclusion

Toyota's after-sales arm is a powerhouse, keeping 150 million cars running and set to be the top earner. With steady growth and smart tech, it's a model for the future. If you're a Toyota owner, book your next service today to keep your car in top shape. For more insights, subscribe to our blog!

Comments

Post a Comment