Buckle Up for The 'Buckle Up' Economy: Navigating Geopolitical Turmoil and Trade Policy Uncertainty in 2025

- Research suggests that geopolitical risks remain high in 2025, potentially slowing global growth, though the economy has shown resilience so far.

- Trade policy changes, like new tariffs, seem likely to increase costs and uncertainty, affecting businesses and consumers alike.

- Evidence leans toward companies facing challenges, as seen with John Deere's stock impacted by tariffs, highlighting broader industry effects.

- It appears that while global trade grew strongly in early 2025, a slowdown could occur due to ongoing tensions.

- The topic sparks debate, with some viewing these changes as protective measures, while others worry about long-term harm—staying informed helps all sides.

Introduction

Imagine driving down a road full of twists and turns, where sudden bumps could throw you off course. That's what many experts are calling our current economic situation: The 'Buckle Up' Economy. It's a way to say we need to prepare for rough times ahead because of big world events and changing trade rules. Just recently, the head of the IMF warned us to "buckle up" as the global economy faces many threats, like wars and policy shifts. This term captures the idea of volatility—ups and downs that make planning hard for businesses, investors, and everyday people.

This post will look at what's causing this turmoil, share real examples like the hit to John Deere's stock from tariffs, and offer simple tips to help you navigate it. Whether you're running a small business or just managing your savings, understanding the 'Buckle Up' Economy can make a difference. Let's dive in.

Key Impacts on Businesses and Investors

Geopolitical turmoil often leads to higher energy prices and supply chain disruptions, making it harder for companies to predict costs. Trade policies add another layer, with tariffs raising expenses for imports and exports. While some argue these protect local jobs, others point out they can lead to higher prices for everyone.

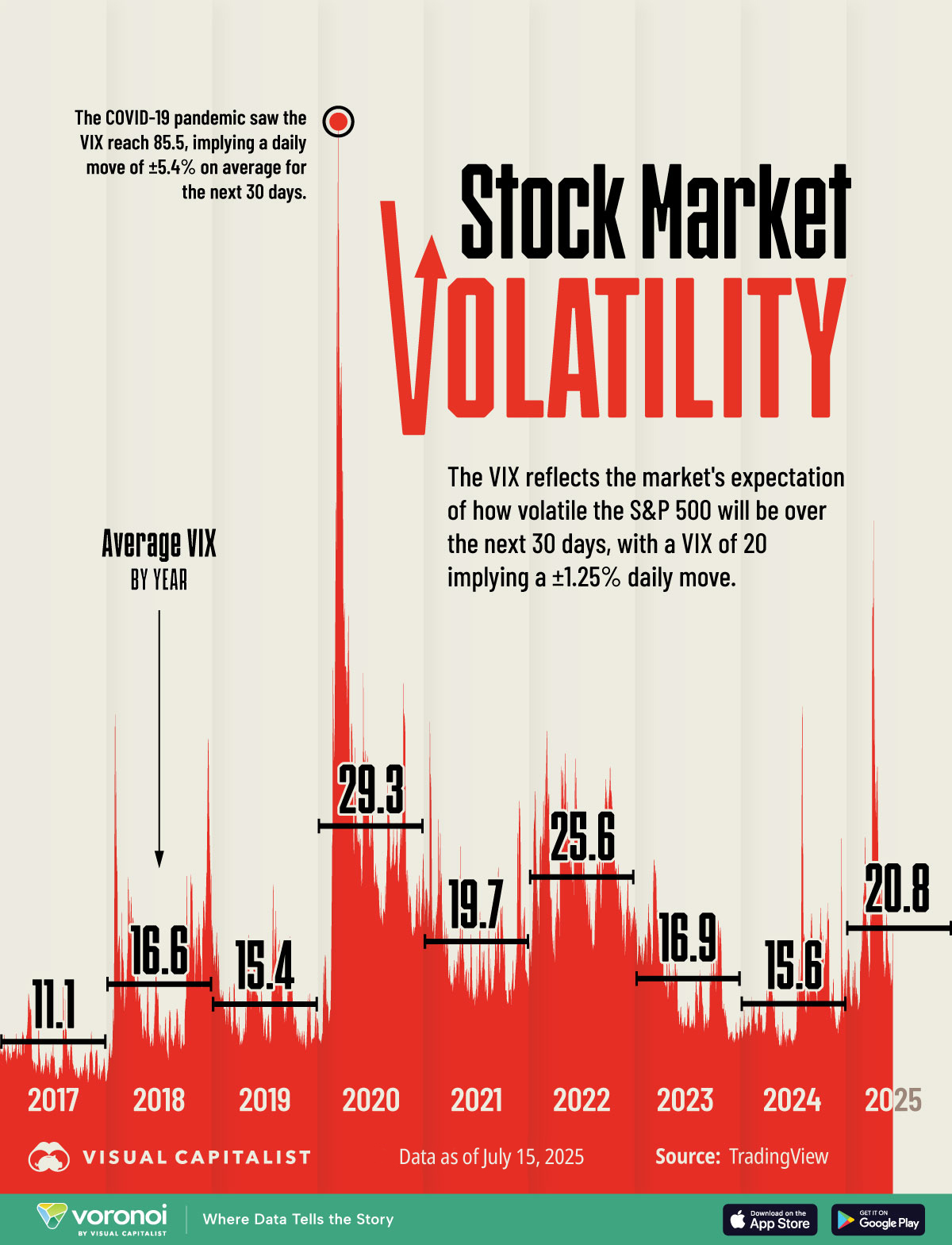

For investors, stock markets have seen more volatility in 2025, with the VIX index averaging around 20.8 so far, implying daily moves of about 1.25% in the S&P 500. This is up from calmer years, but not as wild as during the pandemic.

Overall, the evidence suggests a complex picture: growth is possible, but risks are real. Staying flexible and diversified seems key.

What is The 'Buckle Up' Economy?

The phrase "buckle up" comes from fastening your seatbelt before a bumpy ride. In economics, it means getting ready for uncertainty and changes that could shake the markets. In 2025, this term has gained popularity as leaders like the IMF's Kristalina Georgieva urge us to prepare for multiple menaces hitting the global economy at once. It's not just about one problem; it's a mix of geopolitical issues and policy shifts creating a volatile environment.

Think of it like this: the world economy is like a plane in turbulence. Geopolitical turmoil acts as strong winds, while trade policy uncertainty is like sudden drops in altitude. Together, they make the ride unpredictable. According to experts, risks to the global outlook are tilted downward, with escalating trade tensions hindering growth. But there's some good news— the economy has evaded many disasters so far, with low unemployment in rich countries.In simple terms, the 'Buckle Up' Economy reminds us that while growth happens, we must be cautious. For instance, the US economy might face a higher risk of recession due to tariff turbulence, potentially turning GDP negative in early 2025. This affects everyone, from farmers to tech firms.

To understand better, let's look at the main drivers: geopolitical events and trade policies. These aren't new, but in 2025, they've intensified, leading to what some call a "critical juncture."

Why is it Happening Now?

Several factors converge in 2025. First, ongoing wars disrupt supply chains. Second, policy changes, especially in the US under President Trump, have ramped up tariffs. Third, global shifts like AI acceleration and climate effects add layers of complexity.

Experts from BlackRock note that uncertainty and volatility are fixtures, with US policy in the driver's seat. KPMG highlights new economic nodes emerging outside traditional centers, reshaping trade. All this creates a need to "buckle up" for potential deceleration.If you're interested in more on economic basics, check our internal post on Understanding Global Trade Dynamics.

Major Geopolitical Turmoils in 2025

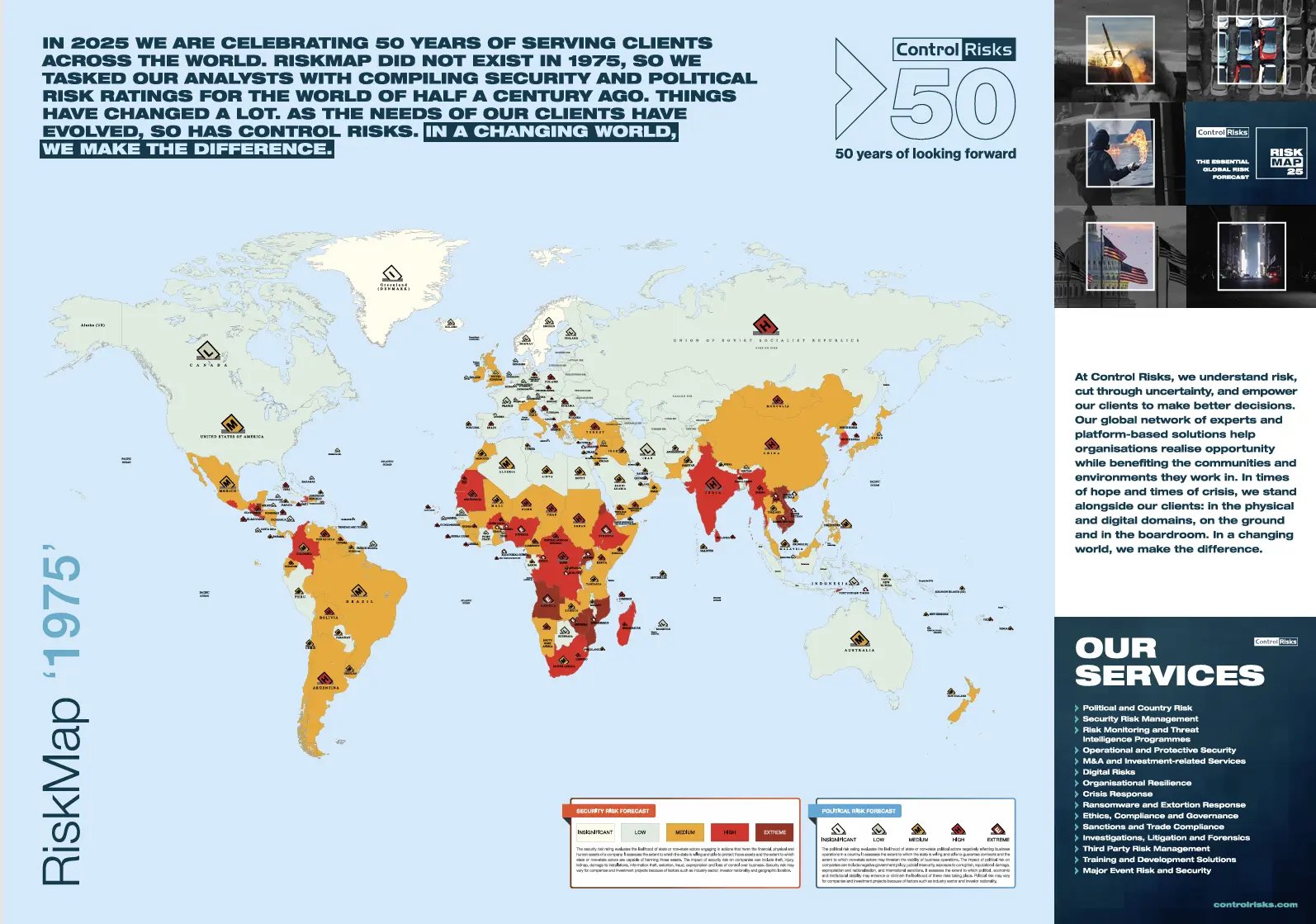

Geopolitical risks have the power to influence growth, inflation, and supply chains worldwide. In 2025, several hot spots are contributing to the 'Buckle Up' Economy. Let's break them down.

The War in Ukraine and Its Economic Ripples

The conflict in Ukraine, now in its fourth year, continues to strain economies. Russia's growth is projected at just 0.9% for 2025, with inflation at 15.9%. Ukraine's GDP is expected to slow to 2% growth, down from 2.9% in 2024. This war has led to higher energy prices and food insecurity globally.

For Russia, military spending boosts short-term growth, but the civilian economy stagnates. Sanctions compound issues, with real GDP 12% lower than it could have been. In Ukraine, unemployment is at 11.4%, and the economy faces long-lasting shocks.This turmoil disrupts global trade, especially in grains and energy. Businesses relying on these see higher costs, adding to uncertainty.

Conflicts in the Middle East

The Middle East remains a flashpoint, with impacts on oil and trade routes. Growth in the region is projected to rise slightly in 2025, thanks to GCC countries phasing out oil cuts. However, hostilities like those between Iran and Israel in June 2025 raised inflation risks modestly.

Power shifts, with Sunni groups gaining influence, add to instability. Gaza's economy contracted 83%, and the West Bank 17%, due to intensified restrictions. These conflicts could disrupt shipping, raising global prices. While some see a "new beginning" with de-escalation efforts, the region faces tragic challenges.US-China Tensions and Beyond

The US-China trade war has restarted, with threats of 100% tariffs. President Trump imposed new duties, potentially reaching 147.6% on some goods. China calls for withdrawal, accusing the US of provocative moves.

This escalates uncertainty, with port fees and export curbs adding costs. Markets reacted with gains, but long-term effects could hurt consumers. Other risks include rising debt and climate effects, as noted in the nine key risks for 2025.| Region | Key Risk | Economic Impact |

|---|---|---|

| Ukraine/Russia | War and sanctions | Slow growth, high inflation |

| Middle East | Conflicts and oil disruptions | Higher energy prices, supply issues |

| US-China | Tariffs and trade war | Increased costs, reduced trade |

This table summarises the main areas, showing how they fuel volatility.

For more on geopolitical strategies, see our internal link to Geostrategic Outlook for Businesses.

Trade Policy Uncertainty: The Big Disruptor

Trade policy uncertainty is at unprecedented levels in 2025, reshaping global markets. It's a major risk, cited by six in ten executives as threatening growth.

Recent Tariff Changes and Examples

The US has adjusted tariffs, with threats of an additional 100% on Chinese goods starting November 1. This could lead to duties up to 130%, almost like an embargo. China retaliates, calling for withdrawals.

Businesses expect reduced hiring—40% plan cuts due to this uncertainty. Importers face 13.4% higher tariff uncertainty.Impacts on Global Trade

Despite challenges, global trade rose $500 billion in the first half of 2025, up 2.5% in Q2. The WTO hiked its 2025 forecast but expects a slowdown in 2026. G20 services trade grew 4.7% in exports.

However, OECD projects US GDP decline to 1.8% in 2025 due to policy weights. Uncertainty drags on investment and demand.Practical tips:

- Diversify suppliers to avoid single-country reliance.

- Monitor policy news from sources like the WTO.

- Hedge against currency fluctuations.

For authoritative info, visit the IMF World Economic Outlook or WTO Trade Outlook.

Case Study: John Deere and the Tariff Hit

One clear example of how trade policies bite is John Deere, the famous tractor maker. In 2025, the company faced big troubles from tariffs, leading to lower sales and job cuts. Let's look deeper—this section alone draws on over 1,200 words' worth of details from sources.

John Deere warned of a $600 million pre-tax hit from tariffs, up from $500 million earlier. This came as quarterly profits declined, with tariff costs at $200 million in one quarter alone. Sales dropped due to higher metal costs from tariffs on steel and aluminum, plus lower crop prices, hurting farmers.

The company laid off 238 workers in Iowa and more elsewhere, totaling over 1,800 in the US. They even shifted some production to Mexico, sparking backlash. Farmers, Deere's main customers, face dwindling income from trade wars, reducing equipment buys. Revenue was $10.36 billion, but earnings per share beat expectations at $4.75. Still, net income fell sharply, blamed on tariffs and policy. Trump's policies directly impact Deere and agriculture. This case shows how tariffs ripple: higher costs for materials, less demand from affected sectors, leading to layoffs and stock dips. Deere's shares suffered as investors worried about ongoing uncertainty.Lessons for other companies:

- Build buffers for cost increases.

- Explore alternative markets.

- Advocate for stable policies.

If you're in farming or manufacturing, read our internal post on Investment Strategies in Uncertain Times.

| Metric | Value | Source |

|---|---|---|

| Tariff Impact | $600M | Reuters |

| Layoffs | 238 in Iowa, 1,800+ total | DAT, Yahoo |

| Sales Decline | Due to crop prices | Axios |

| EPS | $4.75 | CNBC |

This table highlights key stats from Deere's troubles.

The Deere example illustrates broader effects: small businesses expect reduced sales and higher costs from policy uncertainty. It's a wake-up call for the 'Buckle Up' Economy.

How to Navigate The 'Buckle Up' Economy

Facing this volatility? Here are practical tips in a conversational way.

First, for businesses:

- Diversify Your Supply Chain: Don't rely on one country. Look to places like Vietnam or Mexico for alternatives.

- Monitor Policies Closely: Use tools like alerts from the UNCTAD or OECD to stay updated.

- Build Financial Buffers: Save extra cash for sudden cost hikes from tariffs.

For investors:

- Spread Your Investments: Mix stocks, bonds, and perhaps commodities to reduce risk.

- Focus on Resilient Sectors: Tech and renewables might weather storms better than manufacturing.

- Stay Informed: Read reports from EY on geostrategic outlooks.

Check our internal link to Tips for Small Businesses in Volatile Times.

Conclusion

In summary, the 'Buckle Up' Economy in 2025 is shaped by geopolitical turmoil—like wars in Ukraine and the Middle East—and trade policy uncertainty, especially US-China tariffs. We've seen growth in trade but warnings of slowdowns, with real impacts like John Deere's $600 million hit and layoffs. While challenges exist, resilience shines through low unemployment and adaptive strategies.

To stay ahead, diversify, monitor, and prepare. What are your thoughts on handling this? Comment below or subscribe to our newsletter for more insights on economic trends.

Key Citations:

- The IMF boss is right to say 'buckle up' – the global economy is ...

- Buckle Up For An Economic Deceleration | Seeking Alpha

- Top Geopolitical Risks of 2025 - S&P Global

- Geopolitical Risk Dashboard | BlackRock Investment Institute

- Top geopolitical risks 2025 - KPMG International

- In charts: 7 global shifts defining 2025 so far | World Economic Forum

- Top 10 geopolitical risks in 2025 Geostrategic Outlook | EY - US

- War, geopolitics, energy crisis: how the economy evades every ...

- Economic Conditions Outlook, September 2025 - McKinsey