Analyze the Impact of the 2025 US Government Shutdown on the Economy and Beyond

Key Takeaways

- The 2025 US government shutdown, starting on 1 October 2025, has already cost the economy about $15 billion per week in lost GDP growth.

- Around 750,000 federal workers are furloughed, leading to delays in services like air travel and health research, but essential programs like Social Security continue.

- Stock markets have shown resilience with the S&P 500 hitting records, but a longer shutdown could hurt consumer spending and delay Federal Reserve decisions.

- Industries like agriculture and defence may see mixed effects, with companies like John Deere facing added pressure from related economic uncertainties.

- To cope, individuals should budget carefully, while businesses can prepare by diversifying suppliers and monitoring market trends.

Introduction

Have you ever wondered what happens when the government stops running? It's like a big machine grinding to a halt, affecting millions of people and the whole economy. Right now, as of 12 October 2025, the US is in the middle of a government shutdown that started on 1 October. This isn't the first time—there have been many before—but each one brings new challenges. In this blog post, we'll analyze the impact of this recent economic event in simple terms. We'll look at why it happened, what it's doing to jobs, money, and businesses, and how you can handle it.

Let's start with the basics. A government shutdown occurs when Congress can't agree on a budget to fund the government. This time, the fight was over spending levels, foreign aid cuts, and health insurance subsidies. Republicans wanted a simple extension of funding, while Democrats pushed for more protections for things like Affordable Care Act benefits. Talks broke down, and boom—the shutdown began. By 12 October, it's been 12 days, and there's no clear end in sight. That's longer than some past ones but shorter than the 35-day shutdown in 2018-2019.

Why does this matter? Well, the government does a lot more than you might think. It pays workers, runs parks, checks food safety, and collects data on the economy. When it shuts down, some parts stop, and that ripples out. For example, national parks might close, delaying holidays for families. Air traffic controllers work without pay, which could lead to flight delays. And important data like jobs reports aren't released, making it hard for businesses and the Federal Reserve to make decisions.

To analyze the impact properly, we need to think about short-term and long-term effects. In the short term, it's about immediate disruptions. Hundreds of thousands of workers aren't getting paid, so they might spend less at shops. That hurts local businesses. On a bigger scale, the economy slows down. Experts say each week of shutdown knocks off about 0.1% from the country's GDP growth for the quarter. That's like losing billions of dollars in economic activity. The White House estimates $15 billion lost per week. If it lasts a month, that could be a huge hit.

But it's not all doom. History shows that after shutdowns end, the economy bounces back quickly. Workers get back pay, and delayed work catches up. Still, if this one drags on, it could cause more problems, like higher unemployment or lower consumer confidence. Remember the 2013 shutdown? It lasted 16 days and cost the economy about $24 billion overall. This time, with inflation still a worry and interest rates high, the stakes feel bigger.

Let's dive deeper into who gets hit hardest. Federal workers are at the front line. About 900,000 have been sent home without pay, and 700,000 are working but not getting cheques yet. That's tough—bills don't stop coming. Agencies like the Environmental Protection Agency have furloughed 89% of staff, meaning less work on clean air and water projects. The Department of Education is at 87%, so student loans and school grants might slow down.

Travel is another big area. Airports are seeing delays because air traffic controllers are short-staffed. Places like Chicago O'Hare and New York's JFK have reported longer wait times. If you're planning a trip, this could mess up your plans. On the health side, the National Institutes of Health has halted some research, which might delay new medicines. But good news: Medicare and Social Security keep going, so older people aren't left without benefits.

Now, think about the bigger picture for the economy. The shutdown stops key data from coming out, like the September jobs report. Normally, the Bureau of Labor Statistics releases it, but they're shut down. So, we have to rely on private reports, like from ADP, which showed private payrolls dropping by 32,000 in September. That's a sign the job market is cooling, but without official numbers, it's hard to know for sure. The Federal Reserve, which sets interest rates, might delay cuts because they don't have full info. They were planning a cut on 29 October, but this "data void" could change that.

Stock markets are interesting too. You'd think a shutdown would make stocks fall, but so far, the S&P 500 and Dow have hit records in the first week. Why? Investors are betting it won't last long and that lower inflation will lead to rate cuts anyway. But if it goes on, risks grow. Bonds might see yields drop, and gold has risen as a safe haven, topping $4,000 per ounce. The US dollar weakened at first but bounced back. Let's talk about specific industries. Take agriculture—farmers rely on government programs for loans and subsidies. During the shutdown, the Farm Service Agency might not process new applications, hurting planting seasons. John Deere, a big tractor maker, is already facing issues from tariffs, costing them $600 million this year. The shutdown adds uncertainty, as delayed data makes it hard to predict demand. Their stock has risen 21.2% this year, but prolonged disruption could reverse that. Defence is another. Military personnel keep working, but civilian staff are furloughed. This could slow down contracts, affecting companies like Lockheed Martin. On the flip side, some see it as a buying opportunity for defence stocks.Small businesses feel the pinch too. The Small Business Administration has furloughed 23% of staff, so loans might be delayed. If you're a shop owner near a federal office, fewer workers mean fewer customers.

On a personal level, how does this affect you? If you're a federal worker, it's stressful. But even if not, prices might rise if supply chains slow. Consumer sentiment is holding up so far, but economists warn a long shutdown could erode it.

To analyze the impact fully, we should look at past shutdowns. The 1995-1996 one lasted 21 days and cost $1.4 billion. The 2013 one hurt tourism and small firms. This 2025 shutdown is similar but comes after the COVID recovery, so the economy is stronger. Still, with global issues like trade wars, it's riskier.

In summary, for this intro, analyzing the impact shows a mix of short-term pain and potential quick recovery. The longer it drags on, the more damage it causes. Stay tuned as we break it down more in the next sections.

Understanding the Causes of the Shutdown

To properly analyze the impact, we first need to know why it happened. The shutdown started because Congress couldn't pass a new budget for the fiscal year beginning 1 October 2025. The old funding ran out, and without agreement, non-essential parts of the government closed.

The main fights were over money for foreign aid, cuts to spending, and extending health subsidies. For example, there was a $9 billion cut to foreign aid in July, and more are planned. Democrats wanted to protect health insurance for millions, while Republicans wanted to keep spending low. Talks in the Senate failed several times, and even a meeting at the White House on 29 September didn't help.

This isn't new—shutdowns happen when politics get in the way. But this one feels tense because of the elections coming up and economic worries. As of 12 October, it's still going, making it the latest in a line of 22 shutdowns since 1976.

What makes this different? The Supreme Court ruled on 26 September that the president could withhold some funds, adding fuel to the fire. Public opinion is split—some polls blame Republicans more, others Democrats. But everyone agrees it's bad for the country.Analyzing the Impact on Jobs and Workers

One of the biggest ways to analyze the impact is by looking at jobs. The shutdown has furloughed about 750,000 federal workers, meaning they're sent home without pay. Another 700,000 are working but won't get paid until it's over.

This hits hard. Imagine not knowing when your next cheque comes. Many workers live paycheque to paycheque, so they might cut back on spending. That means less money for restaurants, shops, and services. If it lasts long, some might lose jobs permanently—over 4,100 have already been laid off by 10 October.Specific agencies are affected differently:

- Environmental Protection Agency: 89% furloughed, slowing environmental work.

- Department of Education: 87% out, delaying student aid.

- NASA: Most staff are home, but the space station keeps running.

The unemployment rate was 4.3% in August, and the shutdown could push it up if private jobs slow down too. Private reports show job losses, like ADP's -32,000 in September.

For workers, tips include:

- Build an emergency fund for 3-6 months of expenses.

- Look for side gigs or unemployment benefits if eligible.

- Talk to lenders about delaying payments.

Businesses can help by offering discounts to federal workers. Overall, the job impact is temporary but painful.

How the Shutdown Affects the Overall Economy

To analyze the impact on the economy, let's look at GDP. Experts from Oxford Economics say each week reduces growth by 0.1 to 0.2 percentage points. For Q4 2025, it could be as low as 0.1% growth if prolonged.

That's because government spending stops in some areas. The CBO says past shutdowns dampen output, but it rebounds later. This time, with $15 billion lost weekly, a month-long shutdown could cost $60 billion. Consumer spending might drop if confidence falls. The University of Michigan's sentiment index is steady so far, but watch out. Small businesses suffer from delayed loans, and tourism takes a hit with parks closed.On the positive side, essential services continue, and back pay helps recovery. But delayed data makes planning hard.

Practical tips:

- Track your spending and avoid big purchases.

- Invest in stable assets like bonds.

- Businesses: Have backup plans for supply chains.

Impact on Financial Markets and Investments

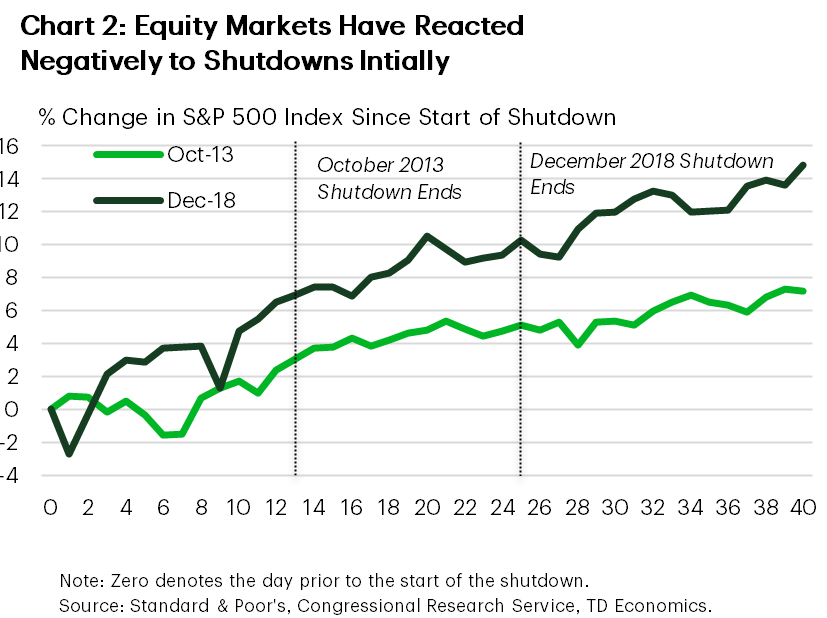

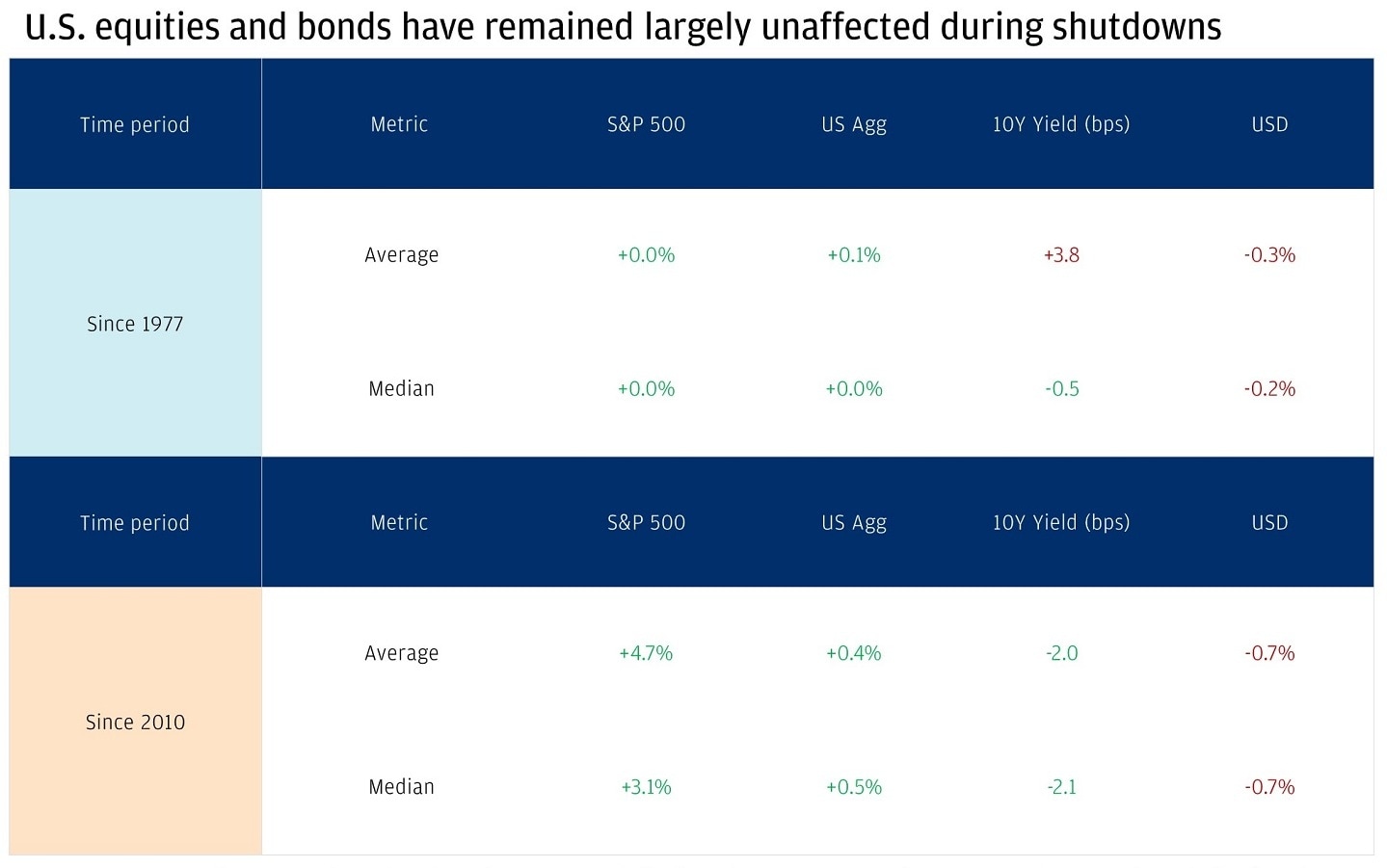

Analyzing the impact on markets shows mixed results. Stocks have risen, with the Dow and S&P 500 gaining in the first week. Historically, shutdowns don't hurt much long-term, as seen in past data where the S&P 500 often recovers.

But risks exist. Bond yields might fall, making them attractive. Gold is up as a safe bet. The dollar dipped, then rose. For specific stocks, defence might benefit from buying opportunities. John Deere, though more hit by tariffs, could see demand drop if farmers get less aid. Their profits are down 35% this year due to costs. Stock up 21.2%, but uncertainty looms.Tips for investors:

- Diversify your portfolio.

- Watch for Fed updates.

- Consider gold or treasuries for safety.

Case Study: John Deere Stock as an Example

To analyze the impact on a specific company, let's look at John Deere. While the shutdown isn't directly about tariffs, it adds to economic uncertainty that affects farmers. Deere expects $600 million in tariff costs for 2025, leading to layoffs and lower profits. The shutdown delays farm subsidies, making farmers buy fewer tractors.

Deere's net income dropped to $1.289 billion in Q3 2025 from $1.5 billion last year. Stock rose 21.2% YTD, but if the shutdown slows agriculture, it could fall. This shows how events like this ripple through industries. Farmers face low crop prices and high costs, worsened by no new loans. Deere isn't freezing US manufacturing—it's investing $20 billion. But uncertainty hurts sales.This example highlights broader impacts: companies in key sectors feel the pinch from delayed government support.

Effects on Specific Industries and Services

Different sectors feel the shutdown differently. Travel: Flight delays at major airports. Health: Research paused at NIH.

Infrastructure: $2.1 billion frozen for Chicago projects. Military: Pay at risk if prolonged.Tips for businesses:

- Plan for delays in permits.

- Use private data sources.

Long-Term Consequences and Lessons

If we analyze the long-term impact, prolonged shutdowns can erode trust in government. Past ones led to credit rating worries, though not this time.

Lessons: Congress needs better budget processes. Bills like the Government Shutdown Prevention Act aim to stop this.

For the future, a stronger economy helps resilience.

Conclusion

In wrapping up, we've analyzed the impact of the 2025 US government shutdown: from GDP losses of $15 billion weekly to job furloughs and market resilience. It's a reminder of how politics affects everyday life. While short-term pain is clear, recovery is likely once resolved.

For more, check our internal posts: How to Invest During Uncertainty and Past Economic Events Analyzed. Also, Impact of Past Shutdowns.

External sources: Read more at the Congressional Budget Office or White House reports.

Call to action: Share your thoughts in the comments—how has the shutdown affected you? Subscribe for more economic insights.