Rare Earths and Rivalries: How China's Control is Shaking Asia's Tech Supply Chain

- Rare earths are vital for tech gadgets like phones and EVs, but China's 70% control of mining creates big supply risks for Asia.

- Recent 2025 export rules from China could slow down chip-making and defence tech in countries like Japan and Taiwan.

- Rivalries between China, the US, and Japan over rare earths go back years, pushing others to find new sources.

- Efforts to diversify, like new mines in Australia and the US, aim to reduce reliance on China by 2040.

- Understanding rare earths helps businesses plan better for a stable tech future in Asia.

Introduction

Imagine your smartphone suddenly becoming twice as expensive, or electric cars taking months longer to build. That's the kind of trouble brewing in Asia's tech world right now, all because of a group of metals called rare earths. These aren't just any metals – they're the hidden heroes behind everything from your laptop screen to wind turbines. But here's the catch: China controls most of them, and that's sparking big rivalries across the globe.

Rare earths are a set of 17 special elements found in the Earth's crust. They're not actually rare, but getting them out and ready for use is tricky and costly. Things like neodymium for strong magnets in headphones or dysprosium for electric car motors rely on them. Without rare earths, modern tech would grind to a halt.

China's grip on rare earths started in the 1990s when it ramped up mining and processing. Today, they handle about 70% of global mining and 90% of processing. That's huge! It means if China decides to limit exports, countries like Japan, South Korea, and Taiwan – big players in Asia's tech supply chain – feel the pinch first. These nations make chips, batteries, and screens that the world needs, but they depend on China for the raw stuff.

But it's not all doom. Countries are fighting back by diversifying. Japan cut its reliance on China from 90% to about 70% by finding sources in Australia and Vietnam. The US is investing in its own mines, like MP Materials, with government help. Even India and Australia are stepping up mining to break China's hold.

In this post, we'll dive deep into what rare earths are, how China's control works, the rivalries it sparks, and tips for businesses to navigate this. We'll look at stats, examples, and practical advice. By the end, you'll see why rare earths are key to Asia's tech future and how rivalries could reshape it.

Let's start with the basics. Rare earths include elements like lanthanum, used in camera lenses, and cerium for polishing screens. They're split into light and heavy types, with heavy ones being pricier because they're harder to find. In tech, they're everywhere – from LEDs to lasers.

China's story with rare earths is one of smart planning. They invested heavily when others didn't, building factories that process the raw ore into usable forms. Now, they produce 270,000 tonnes a year, double what they did in 2024. But this power comes with tensions. The US sees it as a threat to defence, since rare earths are in fighter jets and missiles. In Asia, the supply chain is like a web. Raw rare earths from China go to processors in Malaysia or Vietnam, then to factories in Taiwan for chips, and finally to assemblers in Vietnam or India. Any kink in this chain, like export bans, causes ripples. For instance, Taiwan says it doesn't rely much on China for rare earths, but experts worry about indirect hits through global prices.Rivalries add fuel to the fire. The US and China are in a trade tussle, with rare earths as a bargaining chip. Japan learned from 2010 and now recycles more and seeks new partners. Even Europe is stocking up to avoid shortages.

But why is China tightening controls now? It's partly to protect its environment – mining rare earths is dirty, creating toxic waste. Also, they want to keep high-tech jobs at home. The new rules require licences for tech used in mining and processing, making it harder for foreigners to copy.

For businesses in Asia, this means planning ahead. Stockpile rare earths if possible, or switch to alternatives like recycling. Companies like Apple are already looking at recycled rare earths for iPhones.

As we explore further, remember: rare earths aren't just metals; they're the battleground for tech dominance in Asia.

What Are Rare Earths and Why Do They Matter?

Rare earths are a group of 17 elements that power our modern world. Let's break them down.

The List of Rare Earth Elements

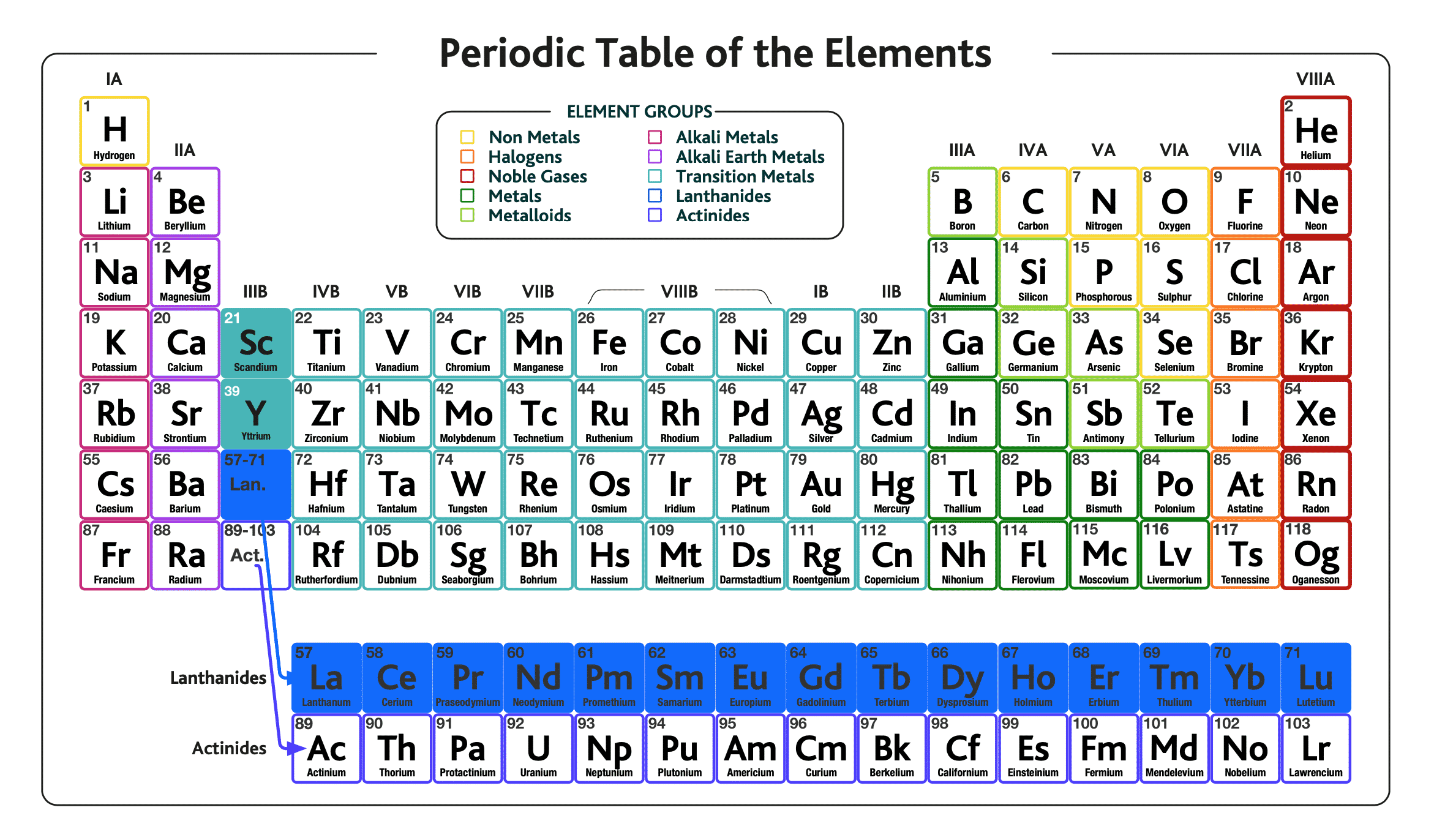

From the periodic table, rare earths include scandium, yttrium, and the lanthanides like lanthanum to lutetium. Here's a quick list with their main tech uses:

- Neodymium (Nd): Makes super-strong magnets for electric cars and wind turbines.

- Dysprosium (Dy): Added to magnets for high-heat spots, like in EVs.

- Europium (Eu): Gives red colour in TV screens and LEDs.

- Cerium (Ce): Polishes glass for phones and cleans exhaust in cars.

- Lanthanum (La): In batteries and camera lenses.

These elements have special properties, like strong magnetism or glowing under light, making them perfect for tech.

Uses in Technology

Rare earths are in almost every gadget. For example, a smartphone might use neodymium in its speaker and vibration motor, cerium for the screen polish, and lanthanum in the battery. In EVs, dysprosium helps motors run efficiently. Stats show that magnets take 23% of global rare earth use, catalysts 24%, and electronics like phosphors 3%.

Without them, clean energy goals suffer. Wind farms need rare earth magnets, and solar panels use some for efficiency. By 2030, demand could jump five times due to green tech.China's Dominance in Rare Earths

China rules the rare earth game, and it's not by chance.

How China Took Control

In the 1980s, China started mining big time, while others cut back due to costs. Now, they mine 70% of the world's rare earths and process 90%. Their Bayan Obo mine is the biggest, but it comes with pollution problems.

Recent Export Controls

In 2025, China added rules: exports need licences if they have even tiny Chinese rare earths. This targets defence and chips, denying sales to US military-linked firms. It's a response to US tariffs, showing how trade wars hit supply chains.

Practical tip: Businesses should check suppliers for Chinese links to avoid delays.

Impacts on Asia's Tech Supply Chain

China's control creates waves in Asia.

Risks for Key Countries

Japan imports 70% from China, affecting Toyota's EVs. Taiwan's chip giants like TSMC use rare earths in advanced semis; new rules could raise costs. South Korea's Samsung faces similar issues with displays.

Stats: China makes 93% of magnets, key to tech. A shortage could add 20% to prices.Examples of Disruptions

In 2010, prices jumped 10 times during the Japan ban. Today, firms warn of production halts.

Tip: Diversify suppliers – look to Australia for raw materials.

Rivalries Over Rare Earths

Tensions are high.

US-China Trade War

The US sees rare earths as a defence risk; they're in F-35 jets. China uses controls as leverage.

Japan and Others

Japan's 2010 lesson led to recycling tech. Now, Asia seeks balance.

Efforts to Diversify Supply

Hope is on the horizon.

New Sources and Investments

The US invested $400M in MP Materials. Australia mines 13,000 tonnes yearly. Vietnam and India are growing.

Tip: Recycle e-waste – it can supply 1% now, but more with tech.

Projections: By 2040, China's dominance might ease if efforts continue.

For more on tech chains, check our posts on Asia's Semiconductor Boom and Critical Minerals in EVs. External sources: USGS Rare Earth Facts and IEA Critical Minerals Report.

Conclusion

Rare earths are crucial, but China's control and rivalries pose risks to Asia's tech supply chain. From export bans to price hikes, the impacts are real, but diversification offers a way out. Stay informed and plan ahead.

Call to action: Subscribe to our blog for updates on global resources and tech trends!

Citations:

- China’s Rare Earth Elements: What Businesses Need to Know

- China's New Rare Earth and Magnet Restrictions Threaten ... - CSIS

- How China dominates critical minerals in three charts - Cipher News

- China Clamps Down Even Harder on Rare Earth Exports

- Why Rare Earths Are China's Trump Card in Trade War With US

- Beijing blames the US for raising trade tensions, defends rare earth curbs

- China's new rare earth export controls will impact global chip supply ...

- Western companies warn of China's rare-earth supply chain chaos

- The world's chip supply chain is bracing for fallout from China's rare ...

- Taiwan sees no significant impact on the chip sector from China's rare ...

- The Consequences of China's New Rare Earths Export Restrictions

- Revisiting the China–Japan Rare Earths dispute of 2010 | CEPR

- China Strong-Armed Japan Over Rare Earths. It's a Lesson for the U.S.

- What are tech metals and rare earth elements, and how are they used