Constellation Brands Misses Earnings: Aluminum Tariffs and Economic Uncertainty Take a Toll

Understanding the Factors Behind Constellation Brands' First-Quarter Earnings Miss

Constellation Brands, the powerhouse behind beloved beer brands like Modelo and Corona, recently made headlines with its first-quarter earnings report for the period ending May 31, 2025. The company fell short of Wall Street’s expectations, sparking discussions about the impact of aluminum tariffs and shifting consumer behaviors. This article dives deep into what happened, why it matters, and what it means for the beverage industry, with insights tailored for a diverse audience, including students and professionals in India and beyond.

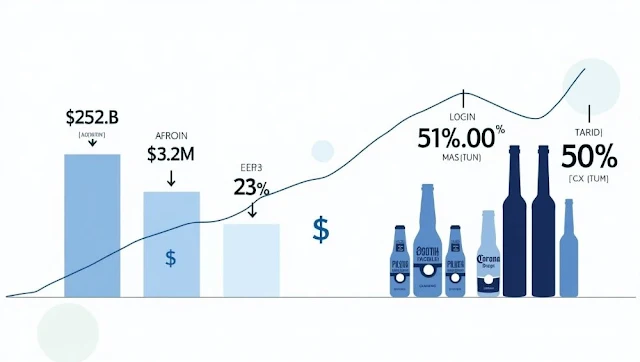

Insert Infographic Here: A visual summarizing key financial metrics, including net sales, earnings per share, and operating margin.

Breaking Down the Earnings Miss

Constellation Brands reported net sales of $2.52 billion, slightly below the analysts’ average estimate of $2.55 billion, according to LSEG data. Their comparable profit was $3.22 per share, missing the expected $3.31. Net income for the quarter was $516.1 million, or $2.90 per share, a significant drop from $877 million, or $4.78 per share, in the same quarter the previous year. This decline was driven by a 5.8% drop in net sales, attributed to weaker consumer demand and the divestiture of Svedka vodka.

The beer segment, which accounts for approximately 80% of Constellation’s revenue, saw a 2.6% decline in quarterly depletion volume, a stark contrast to the 6.4% increase reported a year earlier. Key brands like Modelo Especial and Corona Extra experienced reduced sales, reflecting broader market challenges.

| Financial Metric | Reported | Expected | Year-Over-Year Change |

|---|---|---|---|

| Net Sales | $2.52B | $2.55B | -5.8% |

| Earnings Per Share | $3.22 | $3.31 | Down from $4.78 |

| Net Income | $516.1M | N/A | Down from $877M |

| Beer Depletion Volume | -2.6% | N/A | Down from +6.4% |

The Aluminum Tariff Challenge

A major contributor to Constellation’s struggles was the sharp increase in aluminum tariffs. In mid-March 2025, tariffs on imported aluminum rose to 25%, and by early June, they escalated to 50%. Since aluminum cans are essential for packaging beer, these tariffs significantly increased production costs. The beer business, which includes Mexican imports like Corona, Pacifico, and Modelo, saw its operating margin drop by 150 basis points (1.5%) to 39.1%.

Additionally, tariffs on beer imports have compounded the issue, affecting both Constellation Brands and competitors like Molson Coors. The broader trade policy, including a 10% baseline tariff and specific taxes on steel and aluminum, has created a challenging cost environment. Separate Canadian duties announced in March 2025 could further impact Constellation’s wine and spirits segment, adding another layer of complexity.

Insert Chart Here: A timeline showing the rise in aluminum tariffs (25% in March, 50% in June) and their impact on operating margins.

Economic Uncertainty and Consumer Behavior

Beyond tariffs, Constellation Brands highlighted economic uncertainty as a key factor. CEO Bill Newlands pointed to “non-structural socioeconomic factors,” including fears surrounding U.S. immigration policies under President Donald Trump, which have particularly affected Hispanic consumers, who represent about 50% of the company’s beer sales. This demographic’s reduced spending led to a 3.3% drop in beer shipment volumes.

The broader economic climate, marked by concerns over trade wars and rising costs, has dampened consumer confidence. People are spending less on discretionary items like alcohol, which has hit Constellation’s sales hard. Similar patterns are emerging globally, including in India, where economic pressures influence consumer choices.

Insert Graph Here: A line graph showing consumer confidence trends, with a focus on Hispanic consumer spending in the U.S.

Indian Context: Lessons from Local Breweries

In India, the beverage industry faces similar challenges with taxes and economic shifts. For example, United Breweries and Carlsberg India, major players in the Indian beer market, deal with fluctuating excise duties and state-specific taxes that increase production costs. A small brewery in Bangalore, let’s call it Bangalore Brews, illustrates this struggle. Owner Rajesh, a former teacher turned entrepreneur, faced rising aluminum can costs due to import tariffs. To maintain profitability, he negotiated better supplier deals and reduced marketing expenses, but sales still dipped as price-sensitive customers cut back.

This story resonates with Indian readers, showing how global trade policies impact local businesses. Rajesh’s adaptability—focusing on cost management and exploring local sourcing—offers a relatable example of resilience. Indian students and professionals can draw inspiration from such stories, seeing how small businesses navigate economic challenges.

Company Outlook and Future Guidance

Despite the earnings miss, Constellation Brands remains optimistic, reiterating its fiscal 2026 outlook with earnings per share projected at $12.60 to $12.90 and organic net sales growth between -2% and +1%. This guidance accounts for the increased tariffs, suggesting the company has strategies to mitigate costs, such as price adjustments or operational efficiencies.

However, analysts at JPMorgan Chase have cautioned that the weakening economic environment might warrant a lower guidance (Yahoo Finance). The company’s stock, which closed at $166.42 after a 2.3% increase post-earnings, has still lost over 20% of its value in 2025 due to tariff concerns.

Insert Bar Chart Here: A comparison of Constellation’s fiscal 2026 earnings guidance ($12.60–$12.90) versus analyst expectations ($12.65 average).

Implications for the Beverage Industry

Constellation’s challenges signal broader issues for the beverage industry. Companies like Molson Coors are also affected by aluminum tariffs, which could lead to higher prices for consumers. As costs rise, demand for beers and cocktails may weaken, particularly in an uncertain economy. This could prompt industry shifts, such as increased focus on non-alcoholic beverages or consolidation among smaller players.

In India, similar dynamics are at play. Rising costs could push breweries to innovate, perhaps by developing sustainable packaging or targeting premium segments less sensitive to price changes. For example, Bira 91, an Indian craft beer brand, has gained traction by focusing on unique flavors and branding, a strategy that could inspire others facing cost pressures.

Insert Industry Chart Here: A pie chart showing market share of major beverage companies, including Constellation Brands, Molson Coors, United Breweries, and others.

Actionable Steps for Readers

Whether you’re a student, professional, or investor, here’s how you can apply this knowledge:

- Track Trade Policies: Monitor news on tariffs, especially on aluminum and steel, as they impact industries beyond beverages. Websites like these offer reliable updates.

- Understand Consumer Trends: Analyze how economic changes affect spending, particularly in key markets like India. For instance, follow reports on consumer behavior from sources like Statista.

- Diversify Investments: Spread investments across sectors to reduce risks from tariff-related disruptions. Consider exploring non-alcoholic beverage companies, which may be less affected.

- Learn from Local Examples: Study how Indian businesses like Bangalore Brews adapt to cost increases. This can inspire entrepreneurial strategies or inform investment decisions.

Downloadable Resource: A checklist for monitoring trade policies and their impact on businesses, available at

Conclusion: Navigating a Challenging Landscape

Constellation Brands’ earnings miss highlights the complex interplay of trade policies, economic uncertainty, and consumer behavior. While aluminum tariffs have increased costs, reduced demand reflects broader economic challenges. The company’s reaffirmed guidance shows confidence, but the road ahead requires adaptability. For readers in India and beyond, understanding these dynamics offers valuable lessons for navigating economic shifts, whether as consumers, entrepreneurs, or investors.

Insert Motivational Visual Here: A graphic with a quote like, “Adapt and Thrive: Navigating Economic Challenges with Resilience.”